NO.PZ202403050400000305

问题如下:

According to the data in Exhibit 2, which portfolio most likely exhibits the risk characteristics of an aggressive active equity manager?选项:

A.Japan portfolio B.Eurozone portfolio C.Pacific Rim portfolio解释:

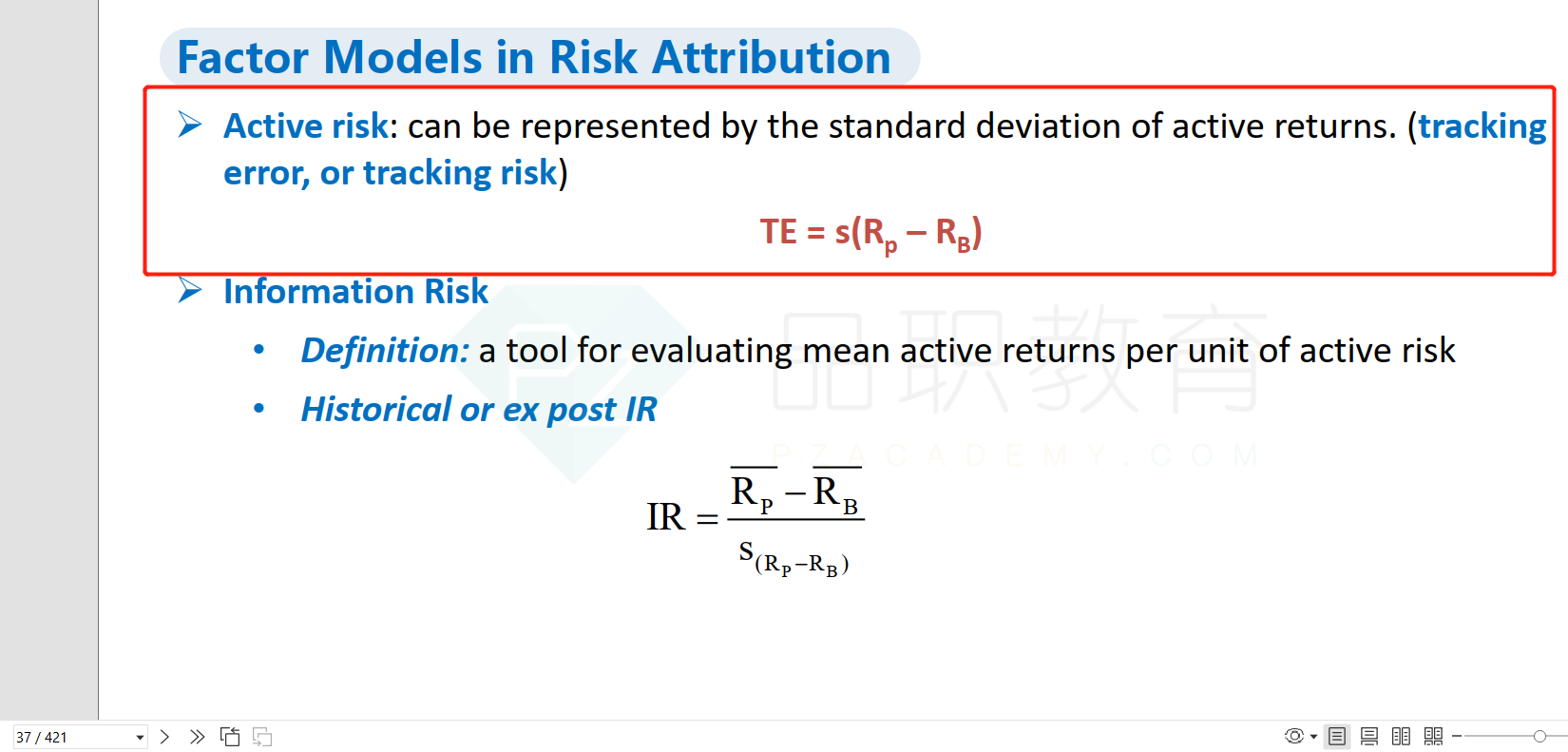

A is incorrect. The Japan portfolio has the highest information ratio, which is not a measure of high tracking error.

B is incorrect. The Eurozone portfolio has the lowest excess return over its local index (12.4% vs. 8.5% = excess return of 3.9%).

C is correct. The Pacific Rim portfolio has the highest tracking error. Tracking error is a synonym for tracking risk or active risk. A well-executed passive investment strategy would achieve the lowest amount of tracking error, whereas an aggressive active equity manager would be expected to have the highest tracking error.

如上感谢!