NO.PZ2023020101000015

问题如下:

Mafadi Consulting Limited is a boutique

financial services company located in Johannesburg, South Africa. Mafadi

specializes in providing commodity and currency hedging solutions to

institutional investors and corporations.

Andre Fourie is a senior client services

consultant for Mafadi. He manages relationships with a number of institutions

to assist with their hedging needs. One of Fourie’s client’s is Global Bullion,

a mining and exploration company headquartered in the United States.

Mbali Ndlovu, a trader on Mafadi’s

derivatives desk, works closely with Fourie to implement solutions for his

clients. Fourie asks Ndlovu to review and calculate the value of a five-year

ZAR20,000,000 swap into which Global Bullion entered two years ago. It is a

receive-fixed, Libor-based interest rate swap with annual resets (30/360 day

count). The fixed rate in the swap contract established two years ago was 3%.

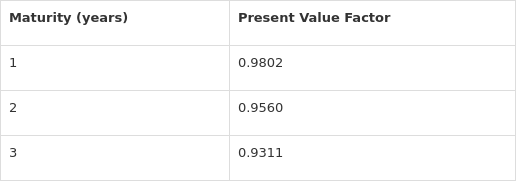

Exhibit 1 estimates the present value factors.

Exhibit

1 Present Value Factors for Five-Year

Swap

The value of Global Bullion’s swap

contract is closest to:

选项:

A.ZAR1,720,380.

B.ZAR1,324,380.

C.

ZAR344,076.

解释:

Calculate the sum of PV = 0.9802 + 0.9560

+ 0.9311 = 2.8673.

Calculate the fixed swap rate = (1 –

0.9311)/2.8673 = 0.0240.

Calculate swap value per ZAR = (0.0300 –

0.0240) *2.8673 = 0.0172.

Thus, total swap value = 0.01720 *

ZAR20,000,000 = ZAR344,076.

RT