NO.PZ2023091601000036

问题如下:

An investor holds a portfolio

of stocks A and B. The current value, estimated annual expected return and

estimated annual standard deviation of returns are summarized in the table

below:

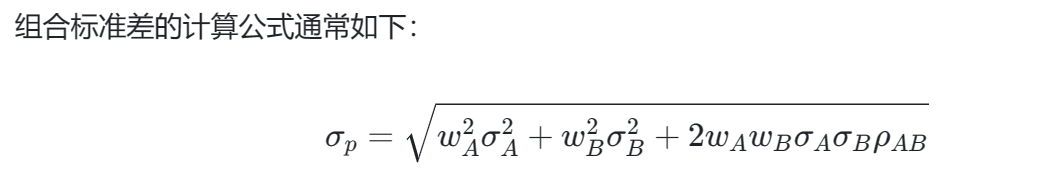

If the correlation

coefficient of the returns on stocks A and B is 0.3,then the expected value of

the portfolio at the end of this year ,within two standard deviations ,will be

between:

选项:

A.

USD 69,00

and USD 134,400

B.

USD

71,800 and USD 145,400

C.

USD

78,200 and USD 139,000

D.

USD

81,400 and USD 135,800

解释:

找不到视频讲解 能否列一下知识点和解题步骤