NO.PZ2023091701000168

问题如下:

An intern on the fixed-income trading desk of an investment bank has been asked to assess the relative value of several bonds issued by the same issuer, with the same maturity date, but with different coupon rates. The intern consults a senior trader about appropriate ways to compare the values of the bonds, and the trader explains the implications of the coupon effect. If the term structure of interest rates is upward-sloping and the bonds are correctly priced in the market, which of the following would the trader be correct to state as a result of the coupon effect?

选项:

A.A bond with a lower coupon rate will be worth more than one with a higher coupon rate. B.A bond with a higher coupon rate will have a lower yield to maturity than one with a lower coupon rate. C.A bond with a higher coupon rate will have a higher Macaulay duration than one with a lower coupon rate. D.A bond with a lower coupon rate will have a lower probability of default than one with a higher coupon rate.解释:

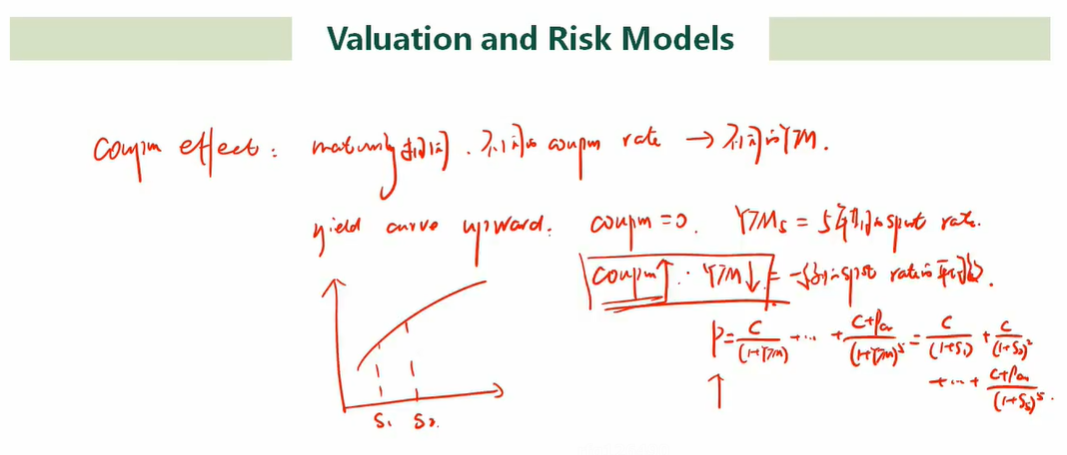

B is correct. When the term structure is upward-sloping, a bond with a higher coupon rate will have a lower YTM.

A is incorrect. When the term structure is upward-sloping, a bond with a higher coupon rate will have a higher price.

C is incorrect. As described in the explanation for D above, when the term structure is upward-sloping, as the coupon increases, the average time to the cash flows decreases. This means Macaulay duration will decrease.

D is incorrect. This is an oversimplification of the relationship between coupon rate and default probability. There are also other factors that come into play.

这道题中的几个利率比较还是没弄懂,请老师帮解释下,和相应的经典题视频点