NO.PZ2023091601000122

问题如下:

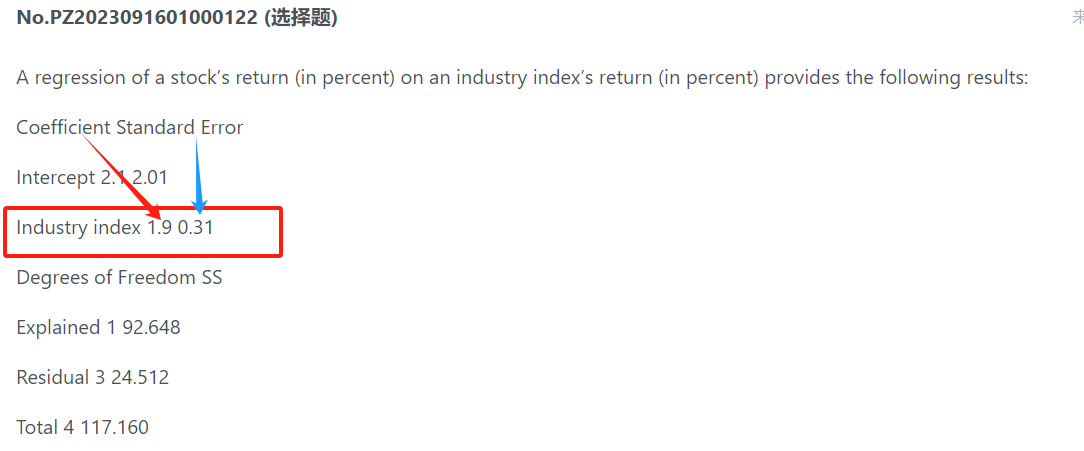

A regression of a stock’s

return (in percent) on an industry index’s return (in percent) provides the

following results:

Coefficient Standard Error

Intercept 2.1 2.01

Industry index 1.9 0.31

Degrees of Freedom SS

Explained 1 92.648

Residual

3 24.512

Total 4 117.160

Which of the

following statements regarding the regression is correct?

I.The correlation

coefficient between the X and Y variables is 0.889.

II.The industry index

coefficient is significant at the 99% confidence interval.

III.If the return on

the industry index is 4%, the stock’s expected return is 10.3%.

IV.The

variability of industry returns explains 21% of the variation of company

returns

选项:

A.III

only

I and II only

II and IV only

I, II, and IV

解释:

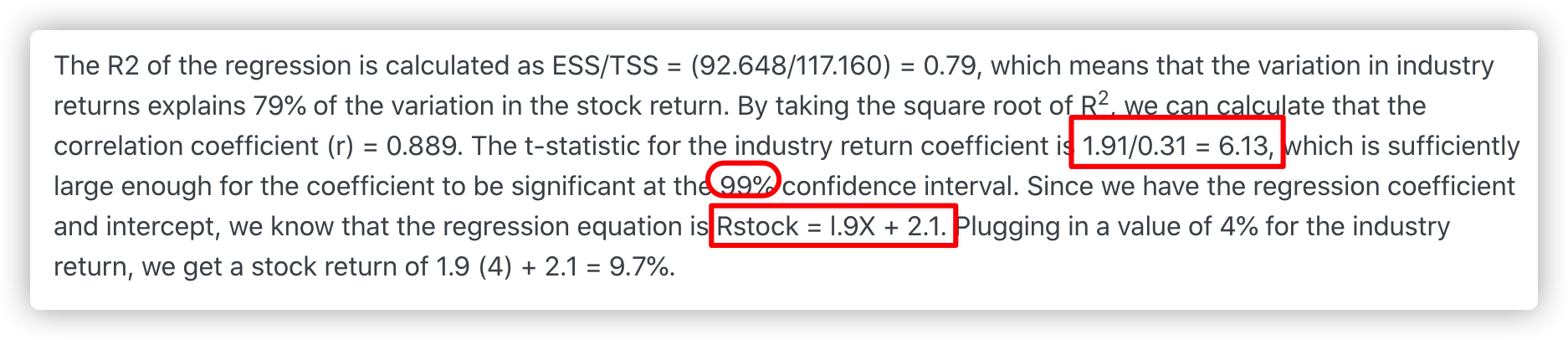

The R2 of the regression

is calculated as ESS/TSS = (92.648/117.160) = 0.79, which means that the

variation in industry returns explains 79% of the variation in the stock

return. By taking the square root of R2, we can calculate that the

correlation coefficient (r) = 0.889. The t-statistic for the industry return

coefficient is 1.91/0.31 = 6.13, which is sufficiently large enough for the

coefficient to be significant at the 99% confidence interval. Since we have the

regression coefficient and intercept, we know that the regression equation is Rstock = l.9X + 2.1.

Plugging in a value of 4% for the industry return, we get a stock return of 1.9

(4) + 2.1 = 9.7%.