NO.PZ2023040501000169

问题如下:

Sallie Kwan Industrials (SKI) reports under US GAAP. The company

disclosed the following information in a note to its financial statements

titled “Share-Based Compensation.”

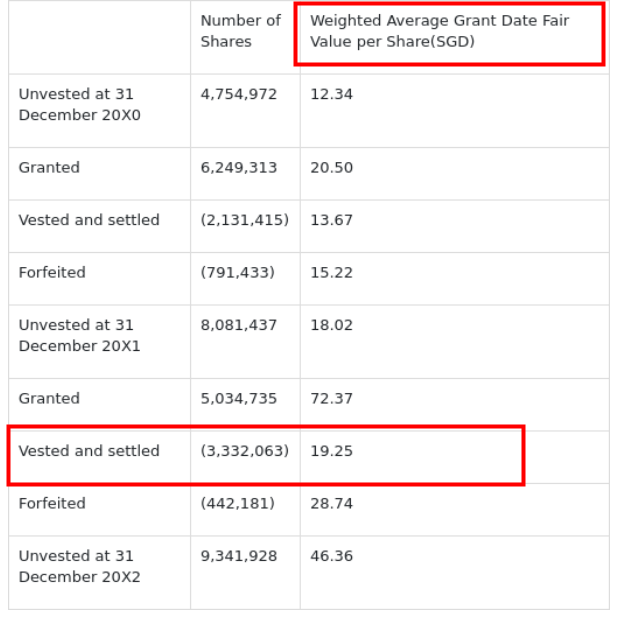

Under our Share Incentive Plan, the Company grants

restricted stock units (“RSUs”) to its officers, employees, directors and other

eligible persons of up to 83,000,000 Class A ordinary shares. RSUs vest 25% on

the first anniversary year from the grant date and the remaining 75% vest in 12

substantially equal quarterly installments. RSU activity for the two years

ended 31 December 20X2 was as follows.

Share-based

compensation expense for RSUs is measured based on the fair value of the

Company’s ordinary shares on the date of grant. SKI accounts for forfeitures as

they occur.

The amount recognized as operating expense on SKI’s income

statement related to its Equity Incentive Plan for the year ended 31 December

20X2 is closest to:

选项:

A.SGD 51.4 million

SGD 64.1 million.

SGD 123.1 million.

解释:

A is correct. The amount recognized as operating expense is

the share-based compensation expense, which the product of 3,332,063 RSUs

vested with a per-share grant-date fair value of SGD 19.25 less forfeitures of

442,181 with a per-share grant-date fair value of SGD 28.74. (3,332,063 x

19.25) – (442,181 x28.74) = 51,433,931.

之前做了一道Option 的题,expense的算法是根据当年的grant然后乘以占整个vesting period的时长比例计算的,理解RSU是到期既行权,所有RSU可以直接算当年vest的作为expense而不用看grant的量是么?