NO.PZ2023040701000087

问题如下:

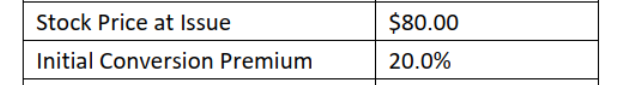

Harding subadvises a core-plus bond fund that allows for up to 5% of assets to be invested in convertible debt. Hamilton has read research from Stellwagen’s equity team that has identified StorageTech equity as a top idea, with a price target of $120 per share. The stock does not pay a dividend and is trading for $90.00 per share on 2 April 2017. Harding asks Hamilton to provide him with the current conversion price, conversion value, and market conversion premium per share based on data in Exhibit 3.

Exhibit 3 StorageTech Convertible Bond Data

Based on this information, Hamilton calculates the conversion value to be $937.50 and the market conversion premium per share to be $10.80 per share.

Is Hamilton most likely accurate regarding her convertible bond calculations?

选项:

A.Yes

B.No. The conversion value is incorrect.

No. The market conversion premium is incorrect.

解释:

Correct Answer: A

The conversion ratio is the par value of the bond divided by the conversion price per share: $1,000/$96 = 10.4167. The conversion value of a convertible bond is equal to the underlying share price times the conversion ratio: 10.4167 × $90.00 = $937.50. The market conversion premium is the convertible bond price divided by the conversion ratio minus the stock price: $1,050/10.4167 = $100.80 – $90.00 = $10.80.

$96 在哪里?