NO.PZ2023040501000024

问题如下:

BetterCare Hospitals, Inc. operates a chain of hospitals throughout the United States. The company has been expanding by acquiring local hospitals. Its largest acquisition, that of Statewide Medical, was made in 2001 under the pooling of interests method. BetterCare complies with US GAAP.

Compared to accounting principles currently in use, the pooling method BetterCare used for its Statewide Medical acquisition has most likely caused its reported:

选项:

A.revenue to be higher.

total equity to be lower.

total assets to be higher.

解释:

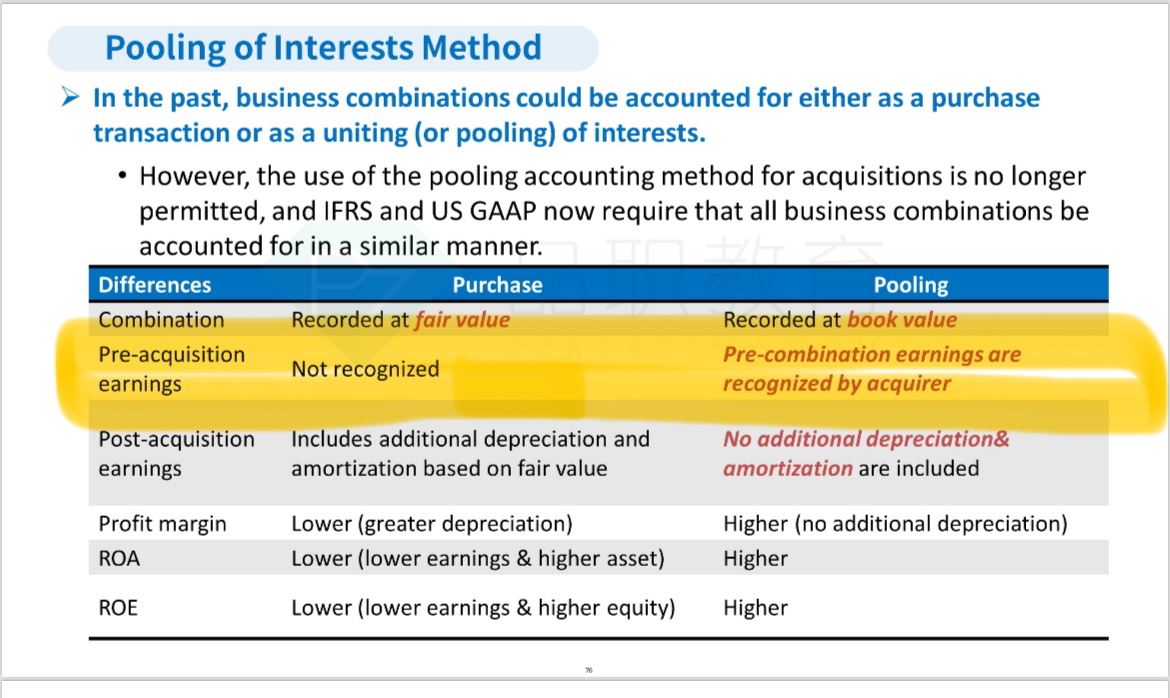

Statewide Medical was accounted for under the pooling of interest method, which causes all of Statewide’s assets and liabilities to be reported at historical book value. The excess of assets over liabilities generally is lower using the historical book value method than using the fair value method (this latter method must be used under currently required acquisition accounting). It would have no effect on revenue.

强化课的讲义里有讲pooling method 会把acquire之前 revenue也算进去所以revenue 会更高,这里为什么A不对?