NO.PZ2023091802000100

问题如下:

A trader executes a $420 million 5-year pay fixed swap (duration

4.433) with one client and a $385 million 10 year receive fixed swap (duration

7.581) with another client shortly afterwards. Assuming that the 5-year rate is

4.15% and 10-year rate is 5.38% and that all contracts are transacted at par,

how can the trader hedge his position?

选项:

A.Buy 4,227 Eurodollar contracts

B.Sell 4,227 Eurodollar contracts

C.Buy 7,185 Eurodollar contracts

D.Sell 7,185 Eurodollar contracts

解释:

Step1. First swap is equivalent to a short position in a bond with

similar coupon characteristics and maturity offset by a long position in a

floating-rate note.

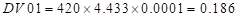

Its

Step2. Second swap is equivalent to a long

position in a bond with similar coupon characteristics and maturity offset by a

short position in a floating-rate note.

Its

Step3. Net DV01 of portfolio = -0.186+ 0.291 =

0.105m = 105,683

Step4. The optimal number is (Note that the

DVBP of the Eurodollar futures is about 25.)

如题