NO.PZ202110280100000104

问题如下:

The implementation shortfall, in basis points (bps), for the sell order of West Commerce shares is closest to:

选项:

A.139. B.198. C.206.解释:

Execution cost = [(–6,000 × 26.80) + (–3,000 × 26.30)] – (–9,000 × 27.10) = 4,200.

Opportunity cost = [–10,000 – (–9,000)] × (26.00 – 27.10) = 1,100.

Fees = 9,000 × 0.03 = 270.

So, the implementation shortfall ($) is calculated as

Implementation shortfall ($) = 4,200 + 1,100 + 270 = 5,570.

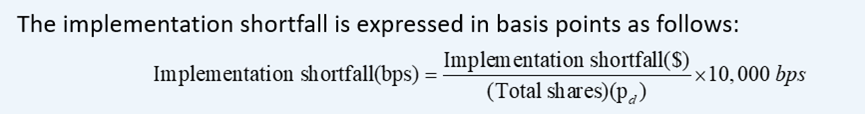

Finally, the implementation shortfall (bps) is calculated as

基础班的ppt好像没有implementation shortfall(bps)的公式?