NO.PZ202312130100000302

问题如下:

Which amount most accurately reflects the difference between Schwalke’s esti-mates of LPE’s required return on equity using the build-up approach versus the expanded CAPM?

选项:

A.1.0% (build-up > expanded CAPM).

1.2% (build-up > expanded CAPM).

2.2% (build-up > expanded CAPM).

解释:

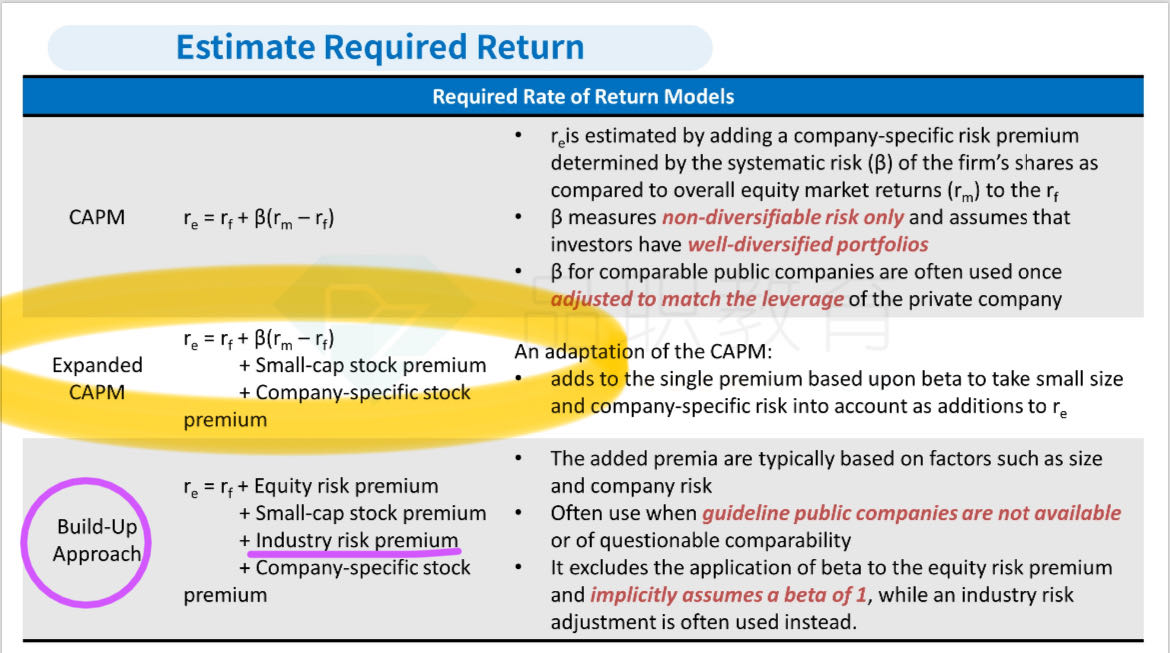

C is correct. The build-up method is the sum of the equity risk premium (6%), small-cap stock premium (2%), company-specific premium (1.5%), and industry risk premium (1%), or 10.5%.

The expanded CAPM reflects the sum of the beta-adjusted equity risk premium (0.8×6%), the small-cap stock premium (2%), and the company-specific premium (1.5%), or 8.3%.

The expanded CAPM reflects the sum of the beta-adjusted equity risk premium (0.8×6%), the small-cap stock premium (2%), and the company-specific premium (1.5%), or 8.3%.

计算expanded CAPM 时不加上industry premium 吗?