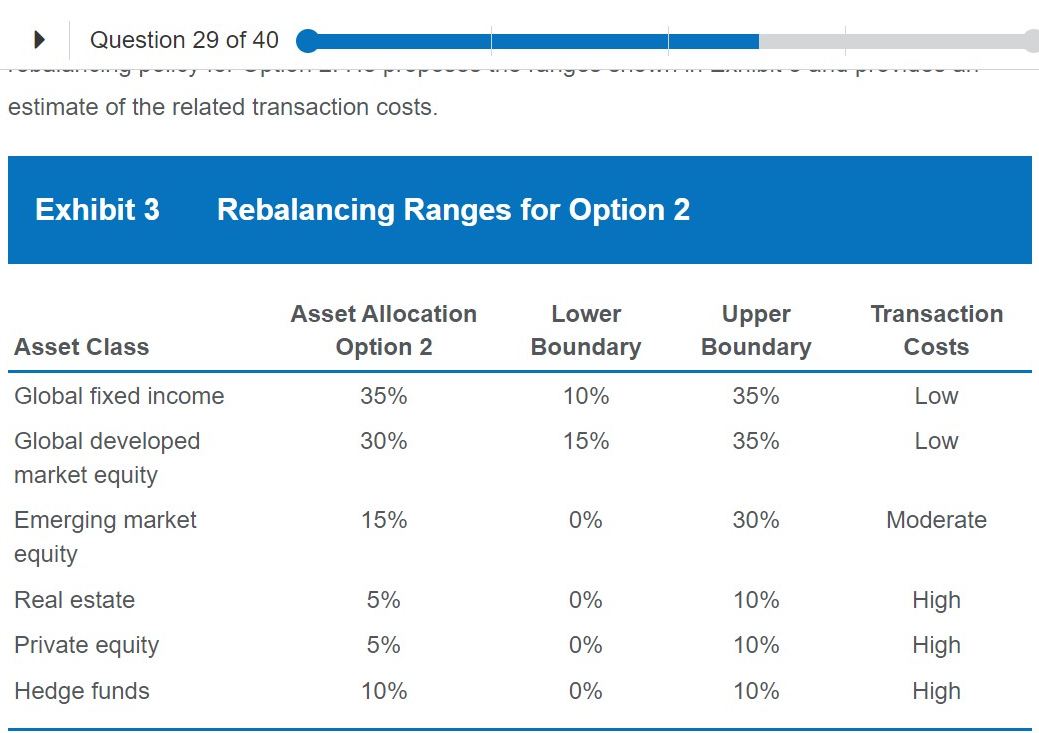

Falana plans to recommend Option 2, believing that the greater certainty of meeting the required year-to-year contributions is the more important objective. She asks Radell to recommend a rebalancing policy for Option 2. He proposes the ranges shown in Exhibit 3 and provides an estimate of the related transaction costs.

Exhibit

Rebalancing Ranges for Option 2

- · A wide rebalancing range for global fixed income is appropriate because of its low volatility, low transaction costs, and low correlation with other asset classes in the portfolio.

- · The allocation for private equity is challenging because a low-cost passive investment vehicle does not exist and modeling with a private equity index captures only the return aspects of private equity without an appropriate representation of risk.

Falana discusses the recommended asset allocation with the Pension Committee. A new committee member, James D’Alessandro, states that his preference would be Option 1 because the best pension funds have adopted the endowment model of asset allocation, which has a higher allocation to alternative investments.

Question

Radell’s statement about the portfolio allocation of private equity in Exhibit 3 is most likely:

- A.

- correct.

- B.

- incorrect in regard to a low-cost passive investment vehicle.

- C.

- incorrect in regard to modeling risk and return with a private equity index.

Solution

C is correct. The statement is incorrect in regard to the risk and return aspects of a private equity index. Private equity indexes do not capture the risk and return attributes of private equity accurately. In addition, owing to the illiquid nature of the constituents, these indexes do not accurately measure their true volatility.

A is incorrect. The statement is incorrect in regard to the risk and return aspects of private equity indexes, which capture neither the risk nor the return attributes of private equity accurately.

B is incorrect. The statement is correct in regard to low-cost passive investment vehicles not being available, which would allow investors to closely track the aggregate performance of private equity and other less liquid asset classes.

Principles of Asset Allocation Learning Outcome

老师这题没懂是什么意思,a low-cost passive investment vehicle does not exist不是有global fuxed income吗,然后后面一句也没懂