NO.PZ2023120801000005

问题如下:

Antelas AG’s existing notes are secured and unsubordinated obligations and rank pari passu with all other secured and unsubordinated indebtedness. Nowadays, Antelas decides to raise new secured, unsubordinated debt. Which of the following best describes the priority of payments between the issuer’s new debt and its existing debt?

选项:

A.Because the Antelas AG notes have a pari passu clause, this debt obligation will be treated the same as any other secured, unsubordinated debt from this borrower.

Because the existing debt was issued earlier, it would receive priority over the new debt in terms of the payment of interest and principal.

We do not have enough information to answer this question; the necessary information would be provided in the indenture for new secured, unsubordinated notes.

解释:

Correct Answer: A

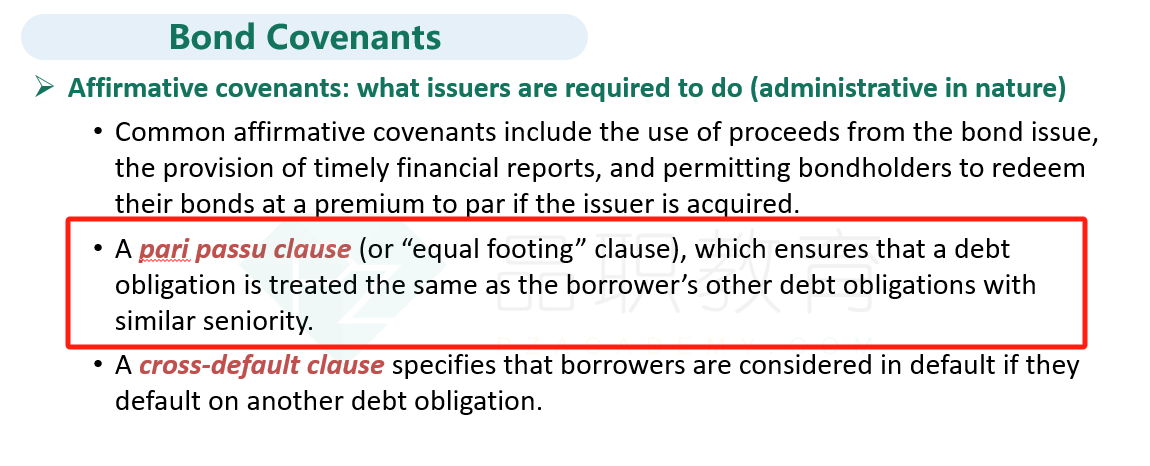

Antelas AG’s existing secured, unsubordinated debt has a pari passu (or “equal footing”) clause, which ensures that this debt obligation will be treated the same as any other secured, unsubordinated debt from this borrower.

B is incorrect because the priority of payments is unrelated to the timing of issuance.

C is incorrect because the pari passu clause ensures equal footing for similar new debt.

这个考点 在哪一张里啊,老师可以讲解一下