NO.PZ2023090401000003

问题如下:

Question A risk manager at a bank is speaking to a group of analysts about estimating credit losses in loan portfolios. The manager presents a scenario with a portfolio consisting of two loans and provides information about the loans as given below:

Assuming portfolio losses are binomially distributed, what is the estimate of the standard deviation of losses on the portfolio?

选项:

A.CNY 1.38 million

B.CNY 1.59 million

C.CNY 3.03 million

D.CNY 3.36 million

解释:

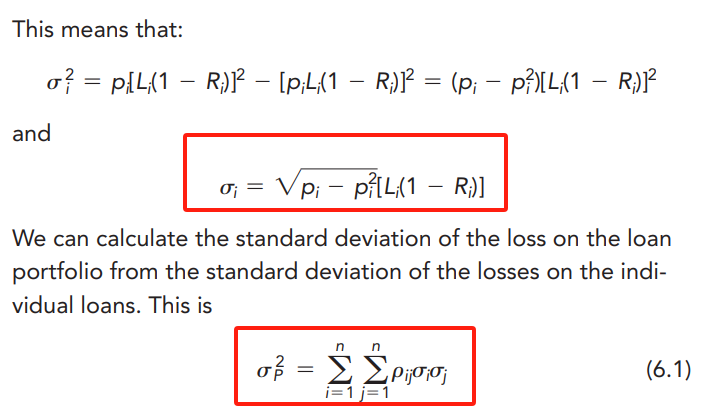

C is correct. The standard deviation of losses (si) for each individual loan is:

where, pi represents probability of default (p1 = 2%, p2 = 2%), Li represents exposure at default (amount borrowed) (L1 = CNY 15 million, L2 = CNY 20 million), and Ri represents recovery rate (R1 = 40%, R2 = 25%)).

Therefore, the standard deviations for loan 1 and loan 2 are:

The variance of losses on the portfolio can then be calculated as:

The standard deviation is therefore √9.1728 = 3.0287.

A is incorrect. This uses the incorrect formula for standard deviation of losses of the individual loans

B is incorrect. This incorrectly assumes portfolio standard deviation of losses to be ρ1,2σ1σ2

D is incorrect. This incorrectly assumes portfolio standard deviation of losses to be the sum of the individual loans’ standard deviations of losses.

Section: Valuation and Risk Models

Learning Objective:

Estimate the mean and standard deviation of credit losses assuming a binomial distribution.

Reference: Global Association of Risk Professionals. Valuation and Risk Models. New York, NY: Pearson, 2022. Chapter 6. Measuring Credit Risk

给了一堆算EL的数据,怎么算标准差?