NO.PZ201803130100000401

问题如下:

Contrast, using the information provided above, the results of a reverse optimization approach with that of the MVO approach for each of the following:

i. The asset allocation mix. Justify your response.

选项:

解释:

■ The asset allocation weights for the reverse optimization method are inputs into the optimization and are determined by the market capitalization weights of the global market portfolio.

■ The asset allocation weights for the MVO method are outputs of the optimization with the expected returns, covariances, and a risk aversion coefficient used as inputs.

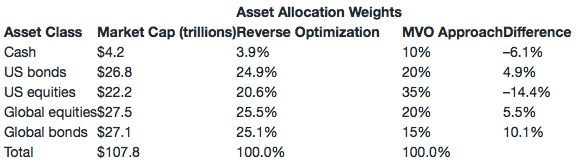

■ The two methods result in significantly different asset allocation mixes.

■ In contrast to MVO, the reverse optimization method results in a higher percentage point allocation to global bonds, US bonds, and global equities as well as a lower percentage point allocation to cash and US equities.

The reverse optimization method takes the asset allocation weights as its inputs that are assumed to be optimal. These weights are calculated as the market capitalization weights of a global market portfolio. In contrast, the outputs of an MVO are the asset allocation weights, which are based on (1) expected returns and covariances that are forecasted using historical data and (2) a risk aversion coefficient. The two methods result in significantly different asset allocation mixes. In contrast to MVO, the reverse optimization method results in a 4.9, 5.5, and 10.1 higher percentage point allocation to US bonds, global equities, and global bonds, respectively, and a 6.1 and 14.4 lower percentage point allocation to cash and US equities, respectively.

The asset allocation under the two methods is as follows:

第一题的第二小问为什么使用CAPM来求资产大类的implied return?

课程中何老师是说用资产大类的市值权重来求?