NO.PZ2023091901000026

问题如下:

The market portfolio (M) contains the optimal allocation of only risky asset and no risky assets. Let the S1 be the Sharpe ratio of this market portfolio. There exists a risk-free asset. Initially, an investor is fully (100%) invested in M with a portfolio Sharpe ratio of S1. Subsequently, the investor borrows 30% at the risk-free rate, such that she is 130% invested in the market portfolio (M) where this leverage portfolio has a Sharpe ratio of S2。After the leverage (i.e., borrowing at the risk-free rate to invest +30% in M, is the investor still on the efficient frontier and how do the Sharpe ratios?

选项:

A.

No (no longer efficient), and S2

B.

No, but S2 = S1.

C.

Yes (still efficient), but S2

D.

Yes and S2 = S1.

解释:

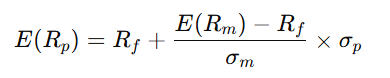

The ability to borrowing or lend morphs the concave/convex efficient frontier into the linear CML; i.e., the leveraged portfolio is efficient with higher risk and higher return.

All portfolios on the CML have the same Sharpe ratio: the slope of the CML.

借钱不是在线外了吗