NO.PZ2020011303000243

问题如下:

A two-year bond with a coupon of 8% and a face value of USD 10,000. There are two buckets: 0-1 year and 1-2 year, and the forward bucket 01s are 1.0358 and 0.9604 correspondingly.

Assume that the term structure is flat at 4% (semi-annually compounded).

Convert the forward bucket 01s to durations.

选项:

解释:

The value of the bond is

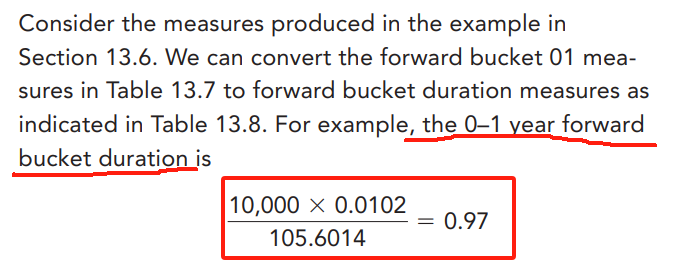

The duration measure for the first forward bucket is

The duration measure for the second forward bucket is

题目问:2年期的债券coupon rate是8%,面值是10k,当有2个buckets:0-1年和1-2年时,forward bucket 01s 为 1.0358 和 0.9604.

假设利率的期限结构是flat,4%的利率,半年付息一次。请将forward bucket 01s转化成为durations。

duration=面值*forward bucket 01/债券价格

duration=面值*forward bucket 01/债券价格

这里为什么不是value而是面值?