NO.PZ202303150300000301

问题如下:

According to the Gordon growth model and the inputs used by Alahtab, CRN's intrinsic value per share as of 20X3 is closest to:选项:

A.$18.07. B.$33.10. C.$35.78.解释:

SolutionC is correct. Using the Gordon growth modelV0 = D0 (1 + g)/(r – g).So,

g = b × ROE

b = 1 – Payout ratio = 1 – (48/120) = 0.6

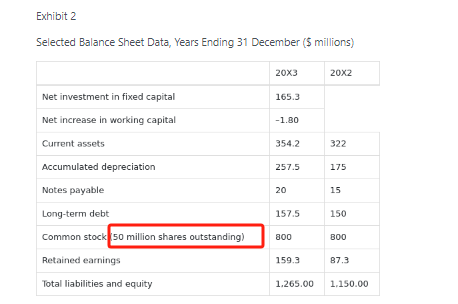

ROE = Net income/Shareholders’ equity = 120/(800 + 87.3) = 13.5

g = 0.6 × 13.5 = 8.1%

D0 = $48 million/50 million shares = $0.96/share

V0 = (0.96 × 1 + 0.081)/(0.11 – 0.081) = $35.78

A is incorrect. It uses payout ratio (instead of retention ratio) to compute g: g = 0.4 × 13.5 = 5.4%; V0 = 0.96 × 1.054/(0.11 – 0.054) = $18.07.

B is incorrect. It uses D0 (instead of D1) in computing V0: V0 = 0.96/(0.11 – 0.081) = $33.10.

D0 = $48 million/50 million shares = $0.96/share

50 million shares 哪里来的?