NO.PZ2023091701000105

问题如下:

A junior risk analyst is modeling the volatility of a certain market variable. The analyst considers using either the EWMA or the GARCH (1,1) model. Which of the following statements is correct?

选项:

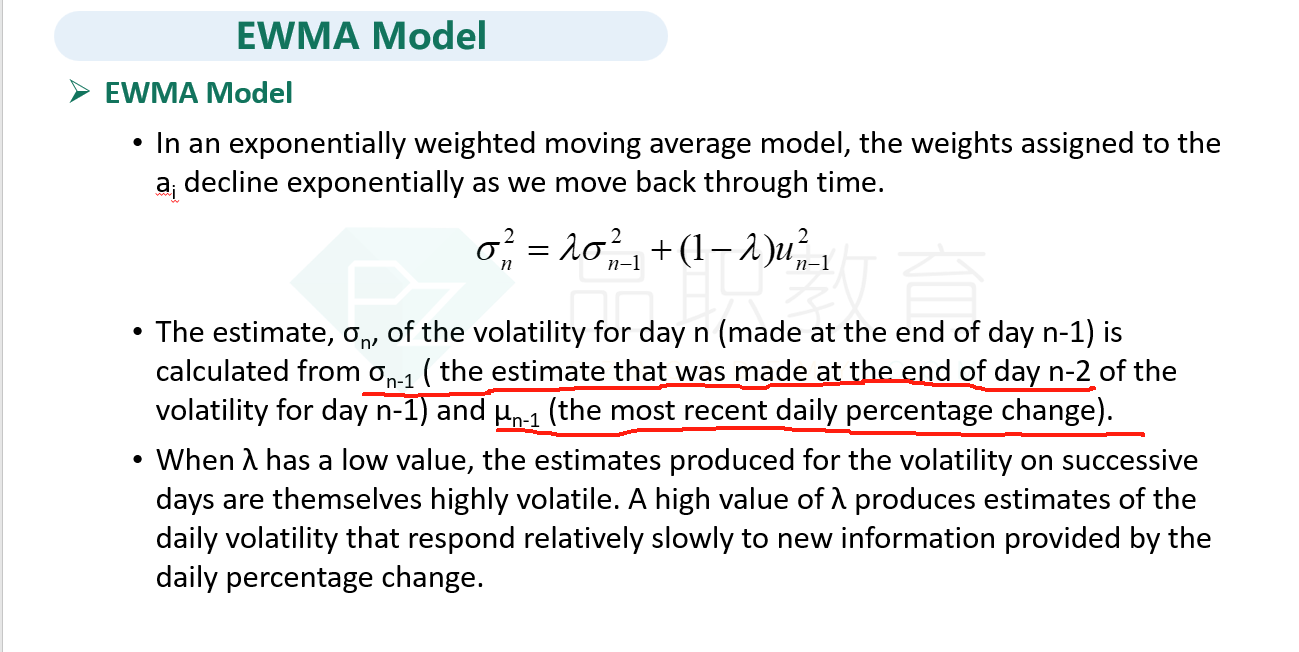

A.The EWMA model is a special case of the GARCH (1,1) model with the additional assumption that the longrun volatility is zero. B.A variance estimated from the GARCH (1,1) model is a weighted average of the prior day’s estimated variance and the prior day’s squared return. C.The GARCH (1,1) model assigns a higher weight to the prior day’s estimated variance than the EWMA model. D.A variance estimated from the EWMA model is a weighted average of the prior day’s estimated variance and the prior day’s squared return.解释:

D is correct. The EWMA estimate of variance is a weighted average of the variance rate estimated for the prior day and the prior day’s observed squared return.

A is incorrect. EWMA is a particular case of GARCH (1,1) with the weight assigned to the long-run average variance rate as zero and the sum of the weights of the other two parameters equal to 1.

B is incorrect because there is also weight assigned to the long-run average variance rate.

C is incorrect because such a comparison can only be done under specific parameter configurations.