NO.PZ2023091701000086

问题如下:

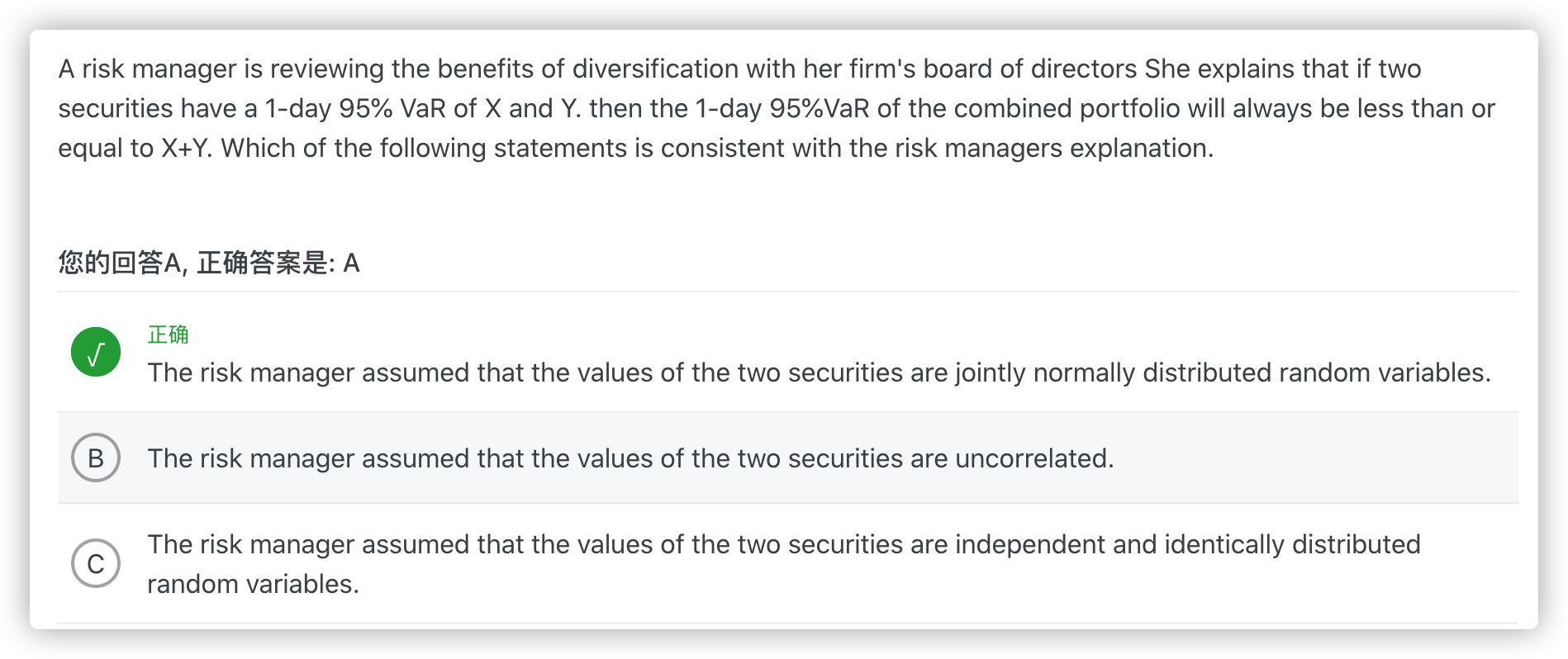

A risk manager is reviewing the benefits of diversification with her firm's board of directors She explains that if two securities have a 1-day 95% VaR of X and Y. then the 1-day 95%VaR of the combined portfolio will always be less than or equal to X+Y. Which of the following statements is consistent with the risk managers explanation.

选项:

A.The risk manager assumed that the values of the two securities are jointly normally distributed random variables. B.The risk manager assumed that the values of the two securities are uncorrelated. C.The risk manager assumed that the values of the two securities are independent and identically distributed random variables. D.The risk manager made no assumptions because VaR is a coherent risk measure. which supports her statement.解释: