NO.PZ2022101402000004

问题如下:

Which of the following statements concerning cost of capital factors is least likely correct?

选项:

A.A company with higher ESG risk is likely to have a higher cost of capital.

B.Companies with primarily tangible assets are able to access debt capital at lower cost.

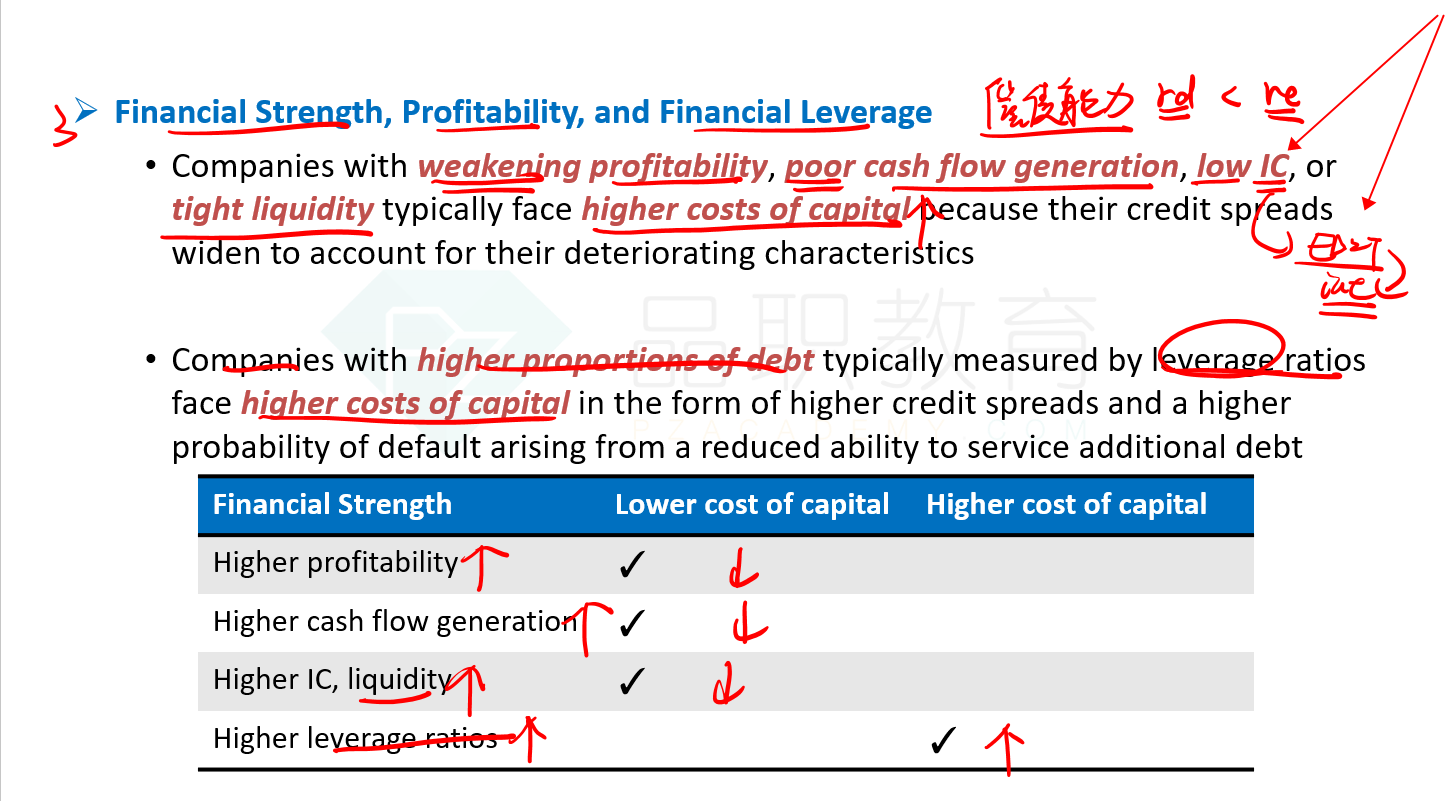

Companies with tight liquidity typically face lower costs of capital.

解释:

C is correct.

Companies with weakening profitability, poor cash flow generation, low IC, or tight liquidity typically face higher costs of capital because their credit spreads widen and idiosyncratic ERPs increase to account for their deteriorating characteristics

low IC, IC 是什么?