NO.PZ2023040701000004

问题如下:

Consider spot rates for three zero-coupon bonds: r(1) = 3%. r(2) = 4%. and r(3) = 5%. Which statement is correct? The forward rate for a one-year loan beginning in one year will be:

选项:

A.

less than the forward rate for a one-year loan beginning in two-years.

B.

greater than the forward rate for a two-year loan beginning in one-year.

C.

greater than the forward rate for a one-year loan beginning in two-years.

解释:

Correct Answer: A

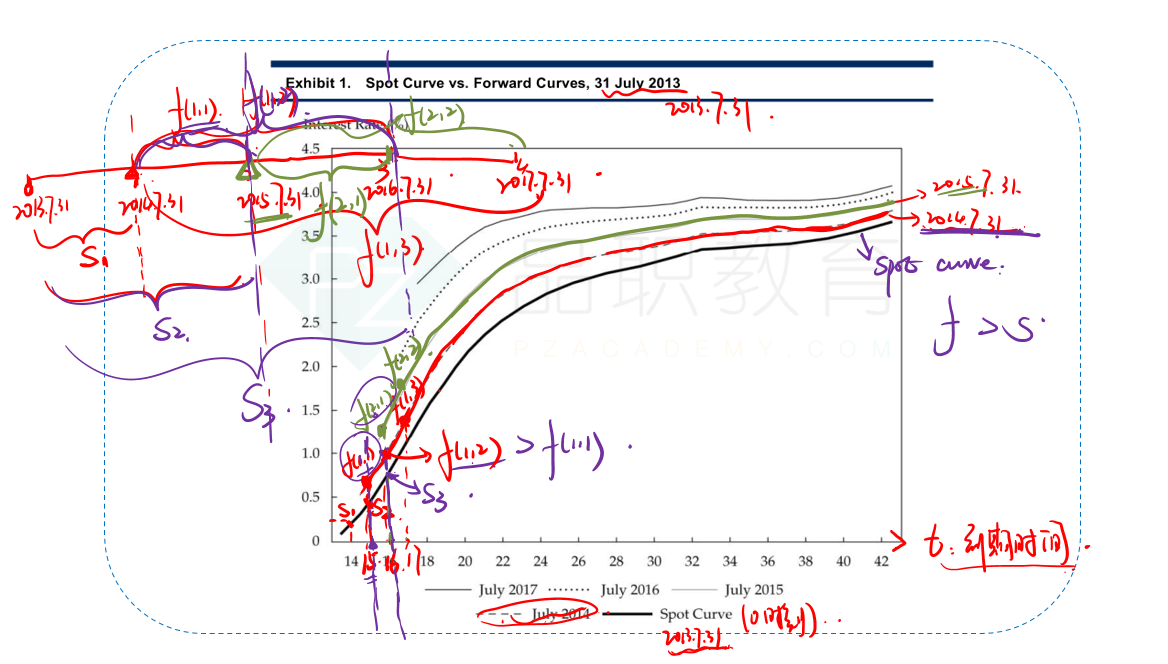

The forward rate for a one-year loan beginning in one-year f(1,1) is

The rate for a one-year loan beginning in two-year f(2,1) is .This confirms that an upward sloping yield curve is consistent with an upward sloping forward curve.

印象中曾说过不同起始时间点的forward rate不能比较,因为不在同一条找上。但何老师在经典题视频却放在一起比较,请老师指教