NO.PZ2018062018000017

问题如下:

According to following information to calculate diluted EPS:

- Net income is $1,650,000 in 2017

- weighted average number of outstanding common shares are 1,000,000

- preferred stock dividend is $200,000

- 25,000 stock options with exercise price of $20/share, average market price is $30/share, at the end of 2017, the price of stock is $18/share

选项:

A.1.57

B.1.43

C.1.30

解释:

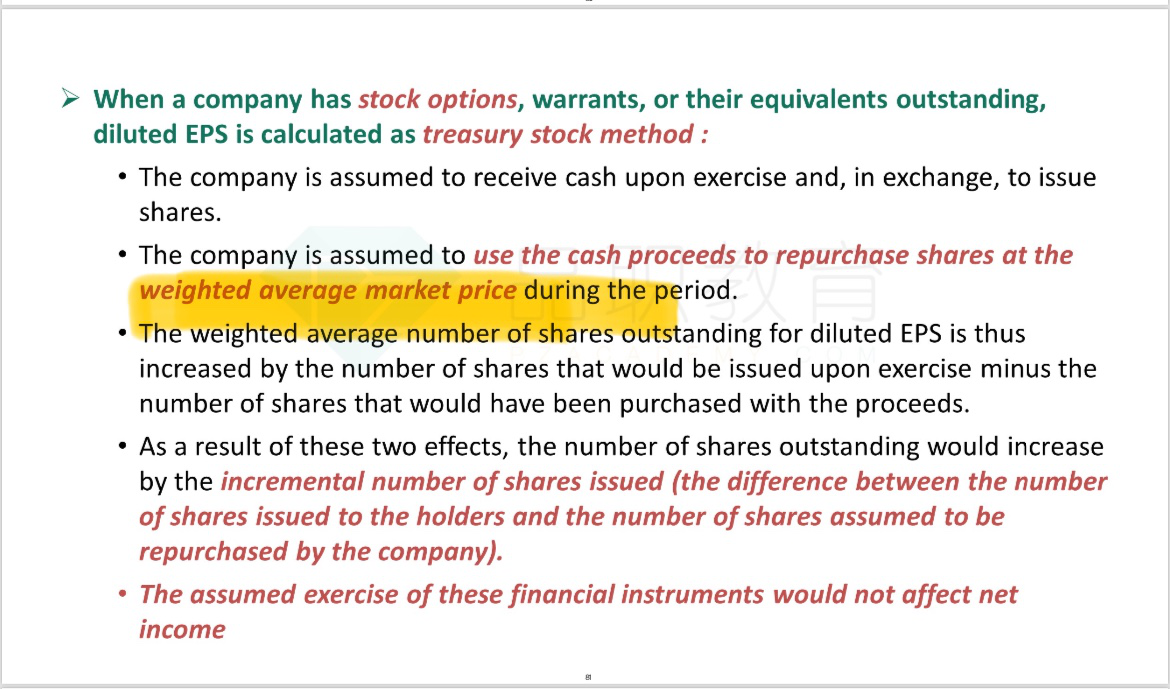

B is correct. diluted EPS=(1,650,000-200,000)/(1,000,000+25,000-16,667)=1.43, 16,667=25,000*20/30

我说下我的做法

diluted EPS=(1650,000-200,000)/(1,000,000+(25,000*10/18))

这样算出来刚好是1.43,答案解析里的做法算出来是1.44

我理解是行权每股赚10块,然后年底用赚的总金额除以当时价格18,这个是增加的股数