NO.PZ2018111302000032

问题如下:

The value per share of REIT A using property subsector average P/AFFO multiple method is closest to:

选项:

A.$49.53.

B.$61.42.

C.$78.24.

解释:

B is correct.

考点:REITs估值方法

解析:AFFO = FFO - Non cash rent - Recurring maintenance-type capital expenditures and leasing commissions = $396,400 – $56,782 - $78,600 = $261,018

AFFO/share = $261,018/73,500 = $3.55

Value per share = AFFO per share * P to AFFO multiple = $3.55 * 17.3x = $61.42

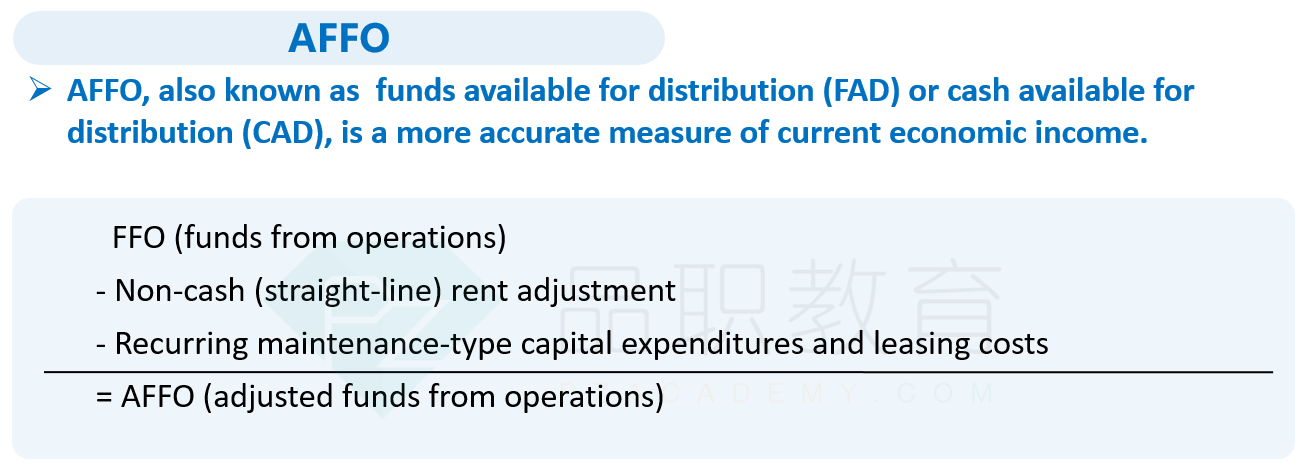

前面有道题公式是 FFO = AFFO + Non-cash (straight-line) rent + Recurring maintenance–type capital expenditures and leasing commissions ”'

那这里AFFO 应该等于 FFO-Non-cash (straight-line) rent + Recurring maintenance “ + ”TYPE capital expenditures and leasing commissions

但这里公式中又是 “—” type cap exp