NO.PZ2024030503000036

问题如下:

QuestionCash Flow Statement for the Year Ended 31 December of Year 2

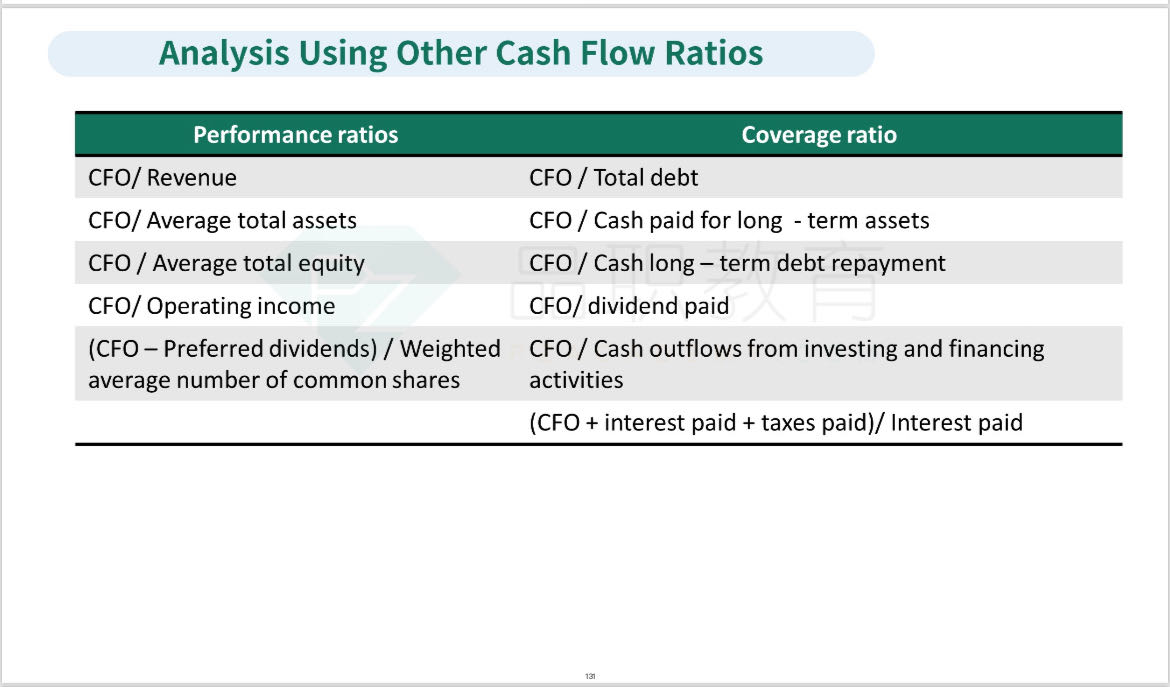

Cash Flow Coverage Ratios

选项:

A.acquire assets improved.

B.pay dividends decreased.

C.acquire assets, pay debts, and make distributions to owners decreased.

解释:

Solution-

Incorrect. The company’s reinvestment coverage ratio worsened. Calculations are as follows:

Reinvestment coverage ratio

-

Correct. The company’s dividend payment coverage ratio worsened; therefore, the company was less able to pay dividends from operating cash flows. Calculations are as follows:

-

Incorrect. The company’s investing and financing coverage ratio improved. Calculations are as follows:

Investing and financing coverage ratio

Analyzing Statements of Cash Flows II

• calculate and interpret free cash flow to the firm, free cash flow to equity, and performance and coverage cash flow ratios

没明白题目,请解释一下题干和答案