NO.PZ2024022701000132

问题如下:

Which of the following statements best describes hedge fund indexes?选项:

A.Index constituents are regulated entities B.Potential survivorship bias is reduced by voluntary performance reporting C.There may be little overlap in index constituents between different indexes offered by different index providers解释:

Solution-

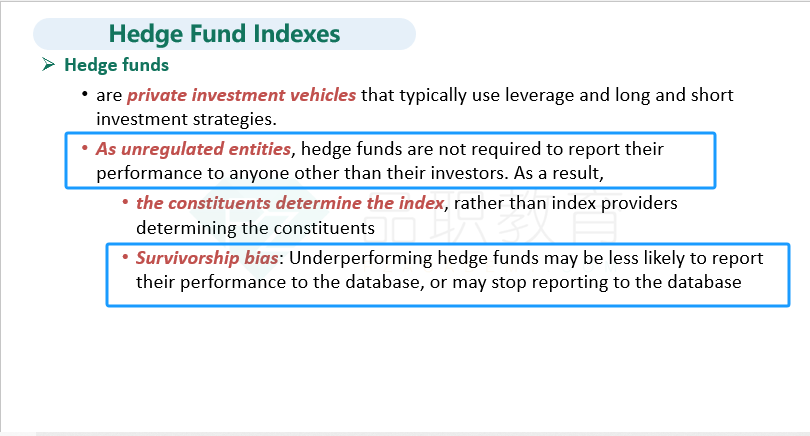

Incorrect because as unregulated entities hedge funds are not required to report their performance. This means a hedge fund index is unlikely to be composed of regulated entities.

-

Incorrect because a consequence of the voluntary performance reporting is the potential for survivorship bias.

-

Correct because frequently, a hedge fund reports its performance to only one database. The result is little overlap of funds covered by the different indices. With little overlap between their constituents, different global hedge funds indices may reflect very different performance for the hedge fund industry over the same period of time.

•

如题