NO.PZ202304050200005003

问题如下:

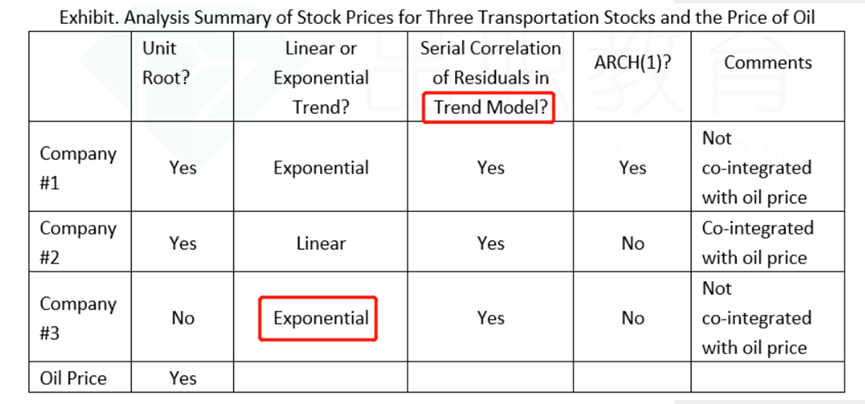

Which single time-series model would most likely be appropriate

to use in predicting the future stock price of Company#3?

选项:

A.Log-linear trend model

First-differenced AR(2) model

First-differenced log AR(1) model

解释:

As a result of the exponential trend in the time series

of stock prices for Company #3, Bake would want to take the natural log of the

series and then first-difference it. Because the time series also has serial

correlation in the residuals from the trend model, he should use a more complex

model, such as an autoregressive (AR) model.

Company #3 没有Unit root,所以不需要用First differencing修正,但有serial correlation的现象,需要用add lagged value,也就是AR(1)→AR(2)

那么为什么此题不选B?