NO.PZ2016012102000203

问题如下:

Parent Company purchased 2,000 shares of Sub Company for $60 per share at the beginning of the year. The dividend paid by Sub Company is $3 per share. The share price of Sub Company was $55 at the end of the year.

Calculate the amount that Parent Company should report in the balance sheet if the securities are regarded as FVPL and if the securities are regarded as FVOCI.

选项:

A.

B.

C.

解释:

A is correct.

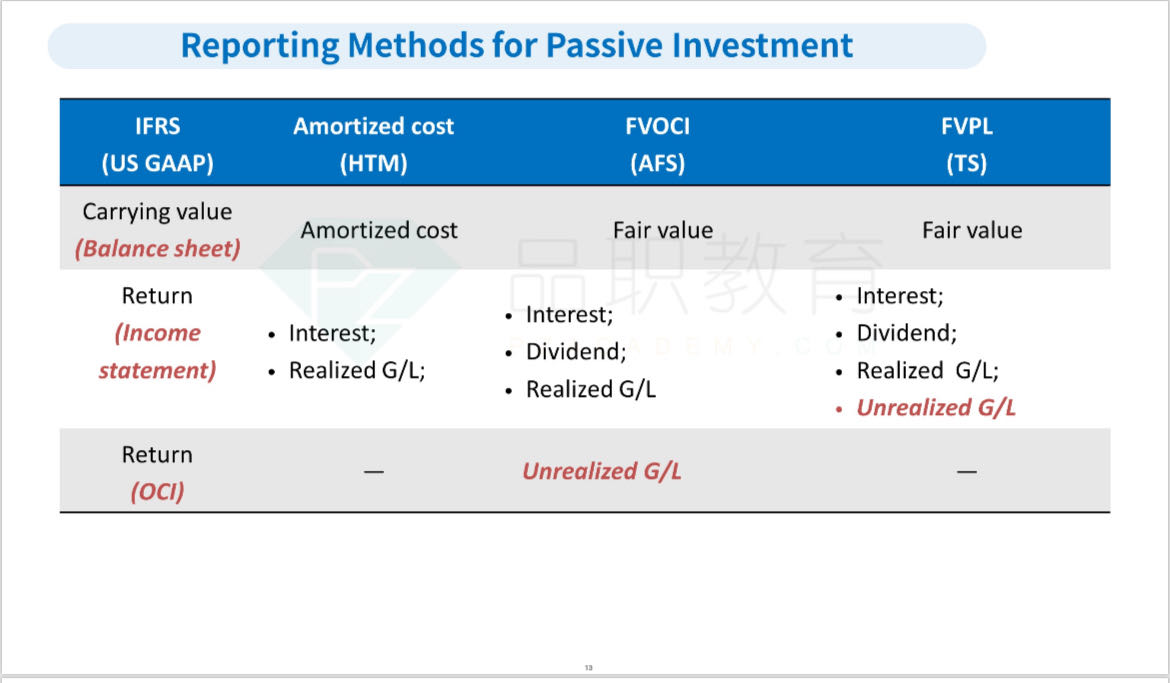

Both of FVPL and FVOCI security are report in the B/S as fair value

FVPL : $55 per share x 2,000 shares = $110,000

FVOCI: $55 per share x 2,000 shares = $110,000

考点: FVPL和FVOCI期末账面价值

不管是FVPL还是FVOCI,入账价值都是fair value,账面金额体现的是金融资产的公允价值,也就是市场上的股价。因此年末,不论归为FVPL还是FVOCI,账面金额都是年末股价55元乘以母公司持有的股票数量2000股,即55×2,000=110,000,选项A正确。

子公司支付分红每股3元,会计处理是,在B/S上增加现金6,000元 = 3 × 2,000,同时I/S上确认股息收入6,000元 = 3 × 2,000。不影响FVPL & FVOCI的期末账面价值。

这道题二者是相同的,什么情况下会不同呢?