NO.PZ201710200100000405

问题如下:

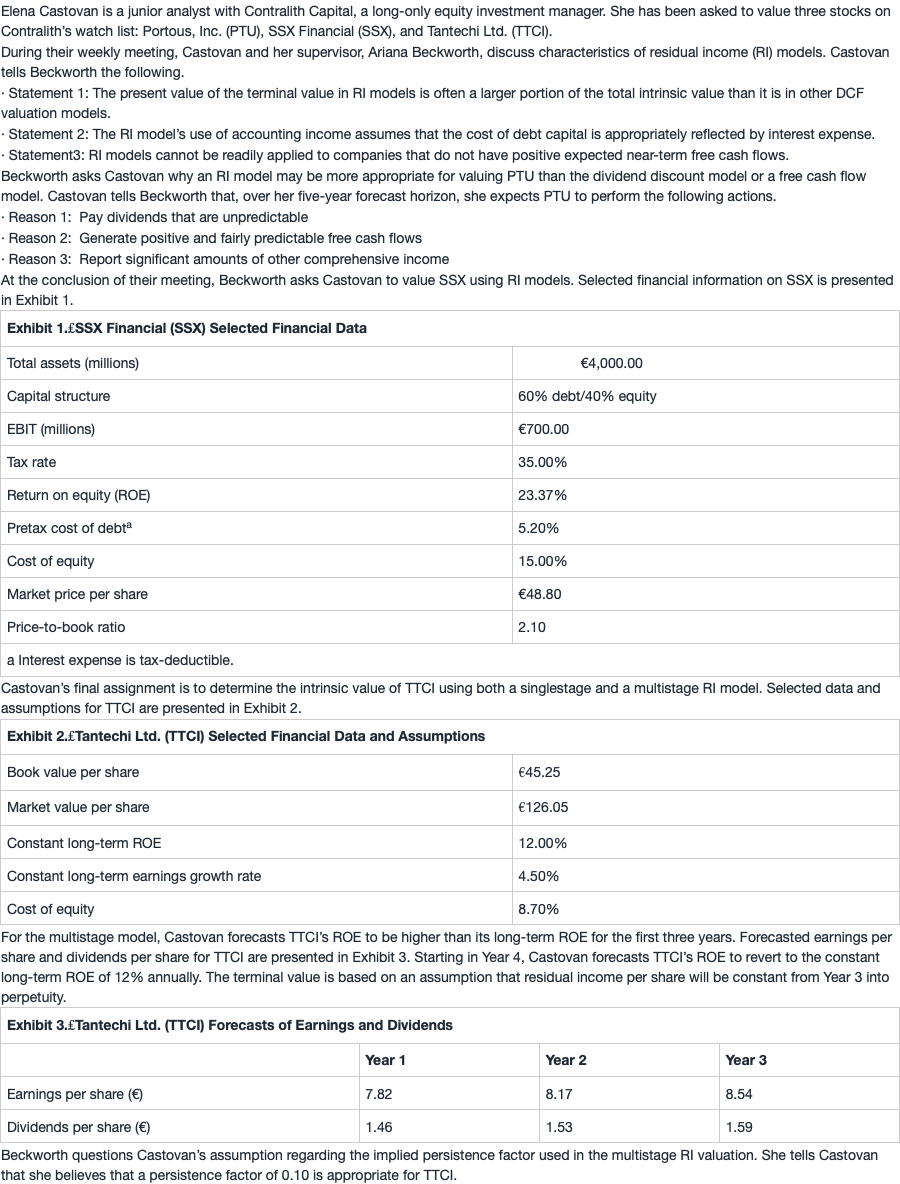

5. Based on Exhibit 1 and the single-stage residual income model, the implied growth rate of earnings for SSX is closest to:

选项:

A.5.8%.

B.7.4%.

C.11.0%.

解释:

B is correct.

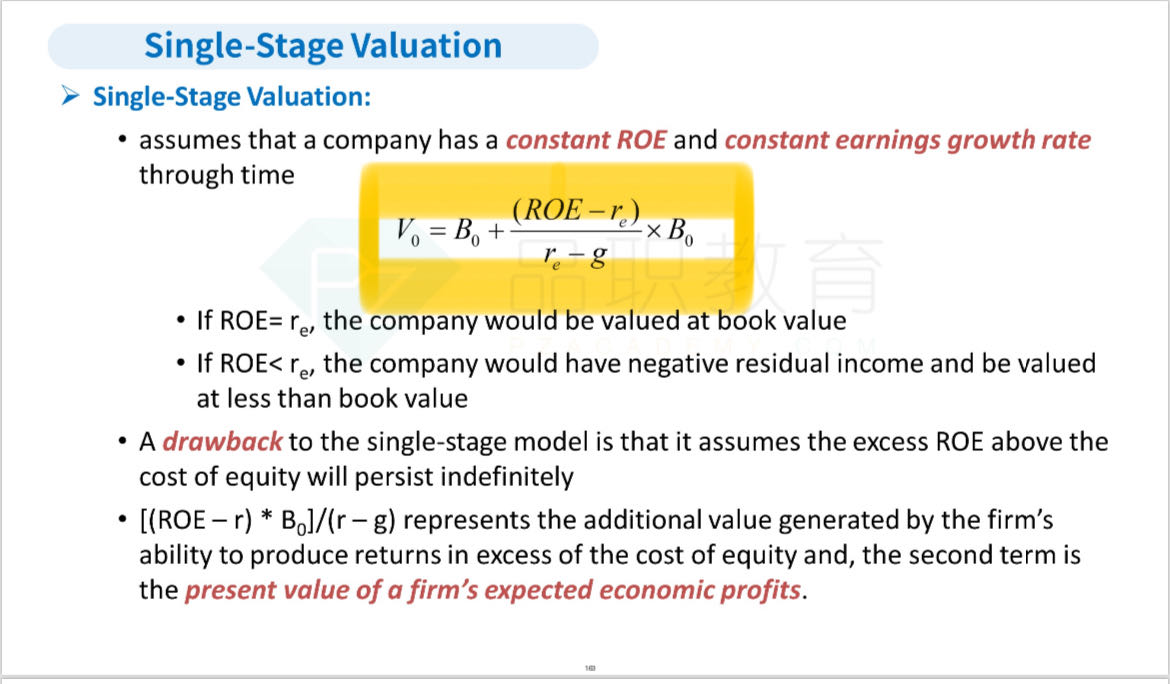

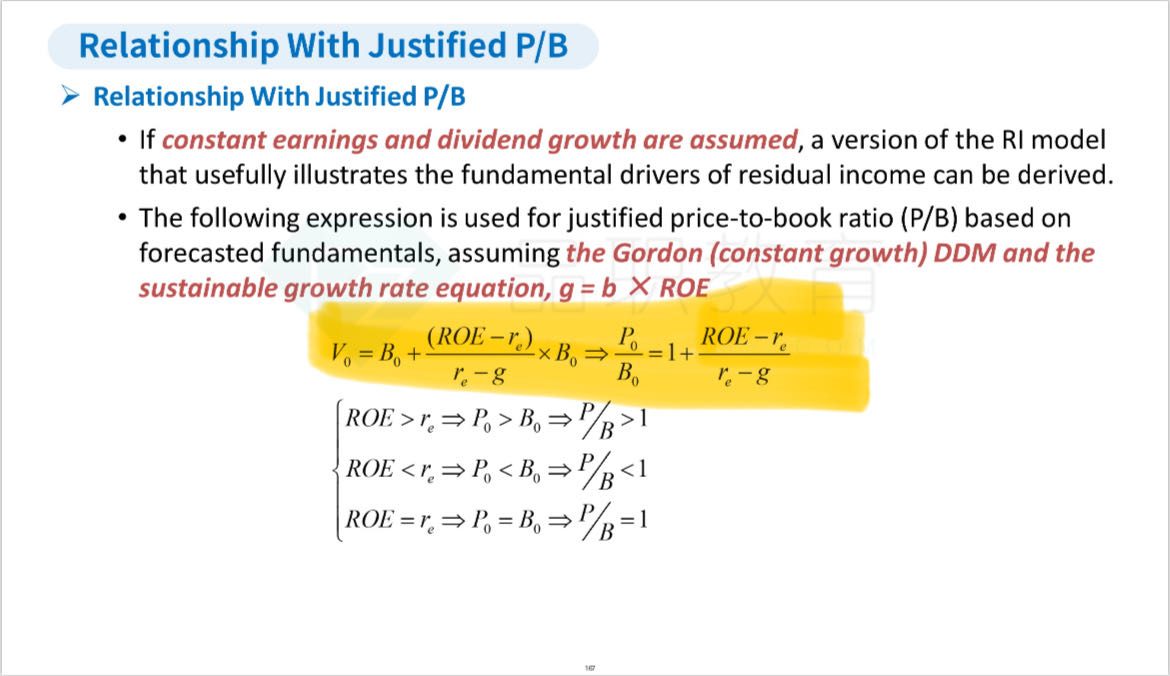

The implied growth rate of earnings from the single-stage RI model is calculated by solving for g in the following equation:

Book value per share can be calculated using the given price-to-book ratio and market price per share as follows.

Book value per share (B0) = Market price per share/Price-to-book ratio

= €48.80/2.10 = €23.24

Then, solve for the implied growth rate

g = 7.4%

前面已经算出该公司的RI为133.9,为什么不能直接带入总的BV of Equity 1600?

Vo=48.8=1600 + 133.9/(15%-g)

是不是因为48.8是MVPS,为了统一,要把BV,以及计算RI的BV都变成per share的形式? 而133.9是通过(ROE-re)*总BV算出的,所以也不能用?