Olivinia Heritage Case Scenario

Olivinia is an oil-rich state in the country of Puerto Rinaldo, which uses the US dollar as its official currency of exchange. In 1981, the state’s legislature created the Olivinia Heritage Fund (OHF) to collect a portion of the state’s non-renewable resource revenue and invest it on behalf of future generations. James Lafferty, the managing director of the fund, is one of the keynote speakers at the Global Wealth Creation Conference. He begins his presentation with a brief overview of OHF’s history (Exhibit 1).

Exhibit 1

An Overview of the Olivinia Heritage Fund

• Phase 1 (1981–1991)

The fund was given an initial allocation of $1 billion by the state. The fund was to receive 10% of all state revenues arising from taxes on oil and gas production and extraction. The fund was given a 20-year accumulation period over which no distributions were allowed and the fund was forecasted to grow to $10 billion. Income earned following the accumulationperiod was to be used to provide for public works and other public infrastructure within the state. Investments were restricted to cash and investment-grade bonds.

• Phase 2 (1991–2001)

By 1991, after being in existence for 10 years, the fund value had grown to $2.2 billion. At this time, transfers of state revenues from taxes on oil-related resources was halted and the government began to use income generated by the fund for direct economic development and social investment purposes. In addition to cash and investment-grade bonds, the investment mandate for the fund was expanded to include investments in private and public companies, real estate, and infrastructure investments. Management of cash and bond investments was performed in-house. For the higher-risk component of the portfolio, the fund hired external managers in an effort to increase return and correspondingly lower the incidence of negative performance. These managers were hired or retained if they had outperformed other active managers in their sectors in at least the prior two years. The fund value at the end of this period was $6 billion.

• Phase 3 (2001–2014)

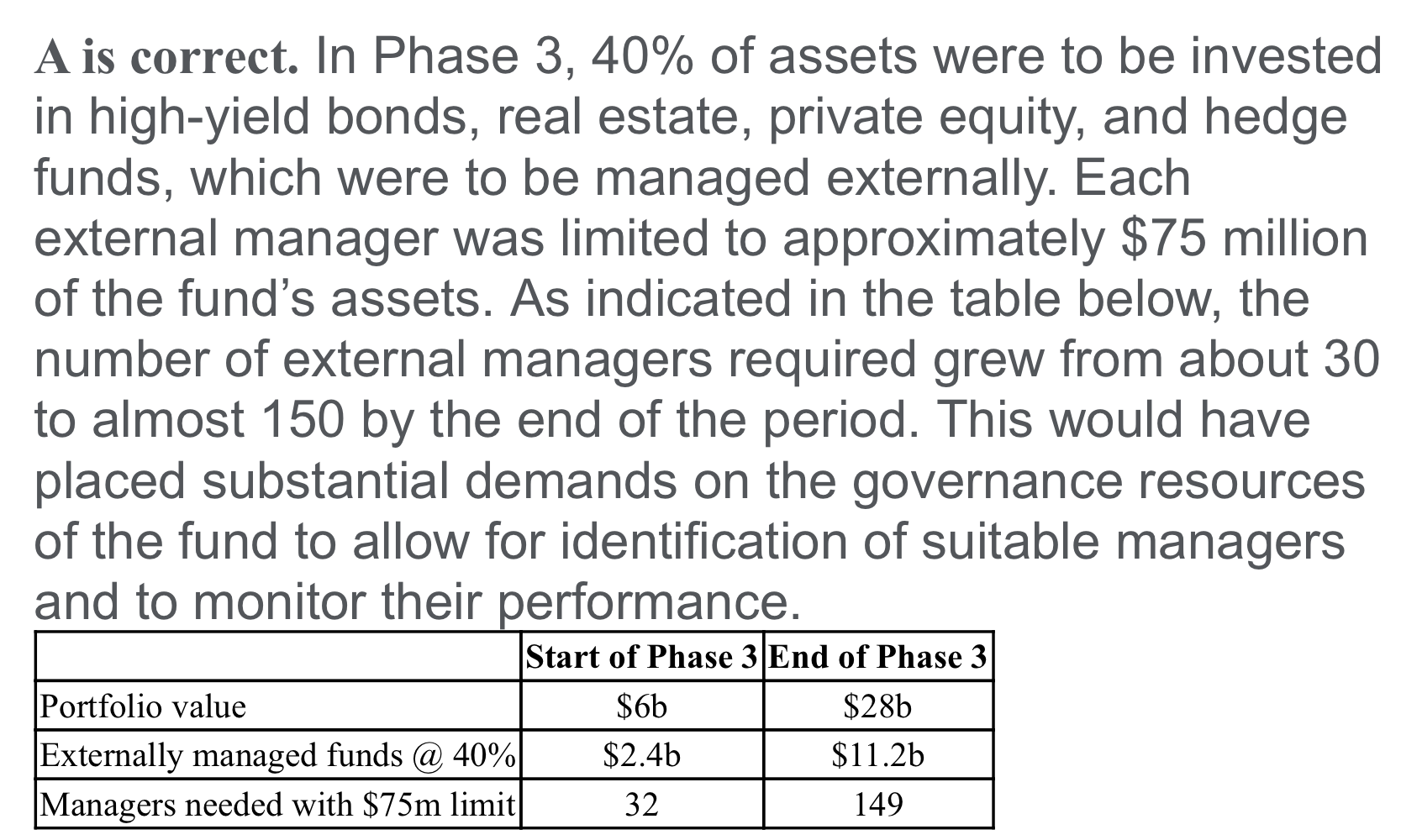

Strong reform legislation related to the original intent of the fund was introduced in 2001. It reinstated transfers of oil-related taxes to the fund, increasing them to 35% of oil- and gas-related state revenues. In addition, the fund was mandated to have 50% in public equities through passive index funds and 10% in cash and investment- grade bonds. The remainder was to be divided equally between high-yield bonds, real estate, private equity, and hedge funds and would continue to be managed externally. All investments were to be made outside the country to avoid overheating the national economy.

Investments managed by individual external managers was limited to approximately $75 million. A two-thirds majority in both the upper and lower legislative bodies was required to change any future legislation related to the fund. By the end of this phase, the fund was worth $28 billion.

In Phase 3, the most likely change in the constraints facing OHF’s ability to undertake asset allocation arose from an increased need for:

A.governance resources.

B.liquidity.

C.risk reduction.

能不能讲讲A的选项解析的表格以及为什么要比较value。governance resources属于哪种constraints: asset size, liquidity needs, time horizon, and regulatory or other considerations