NO.PZ2023040301000165

问题如下:

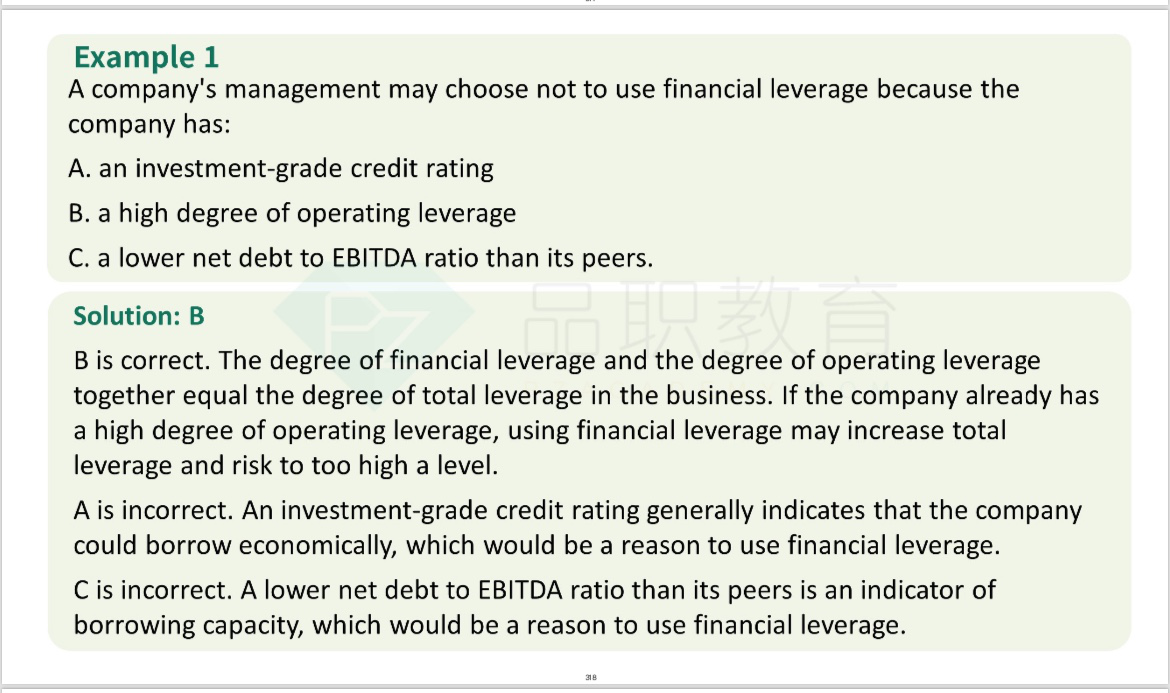

A company's management may choose not to use financial

leverage because the company has:

选项:

A.an investment-grade credit

rating

a high degree of operating leverage

a lower net debt to EBITDA ratio than its peers

解释:

B is correct. The

degree of financial leverage and the degree of operating leverage together

equal the degree of total leverage in the business. If the company already has

a high degree of operating leverage, using financial leverage may increase

total leverage and risk to too high a level.

A is incorrect. An

investment-grade credit rating generally indicates that the company could

borrow economically, which would be a reason to use financial leverage.

C is incorrect. A

lower net debt to EBITDA ratio than its peers is an indicator of borrowing

capacity, which would be a reason to use financial leverage.

C选项为何不对?

lower net debt to ebitda ratio说明负债少,ebitda高,公司靠赚的钱就能运转,而不需要多负债,这个逻辑有问题吗?谢谢!