NO.PZ2018111303000003

问题如下:

PZ company is an education company headquartered in China. It complies with IFRS. In 2018, PZ held a 20% passive equity ownership interest in T-internet company. At the end of the 2018, PZ company decides to increase its ownership interest to 50% T-internet on 1 January 2019 through a cash purchase. There are no intercompany transactions.

At the end of the 2019, which of the following statement is most likely correct about PZ company’s Equity:

选项:

A.the equity will be highest if PZ has control over T company.

B.the equity will be highest if PZ has significant influence over T company.

C.the value of equity is unrelated with accounting method.

解释:

A is correct.

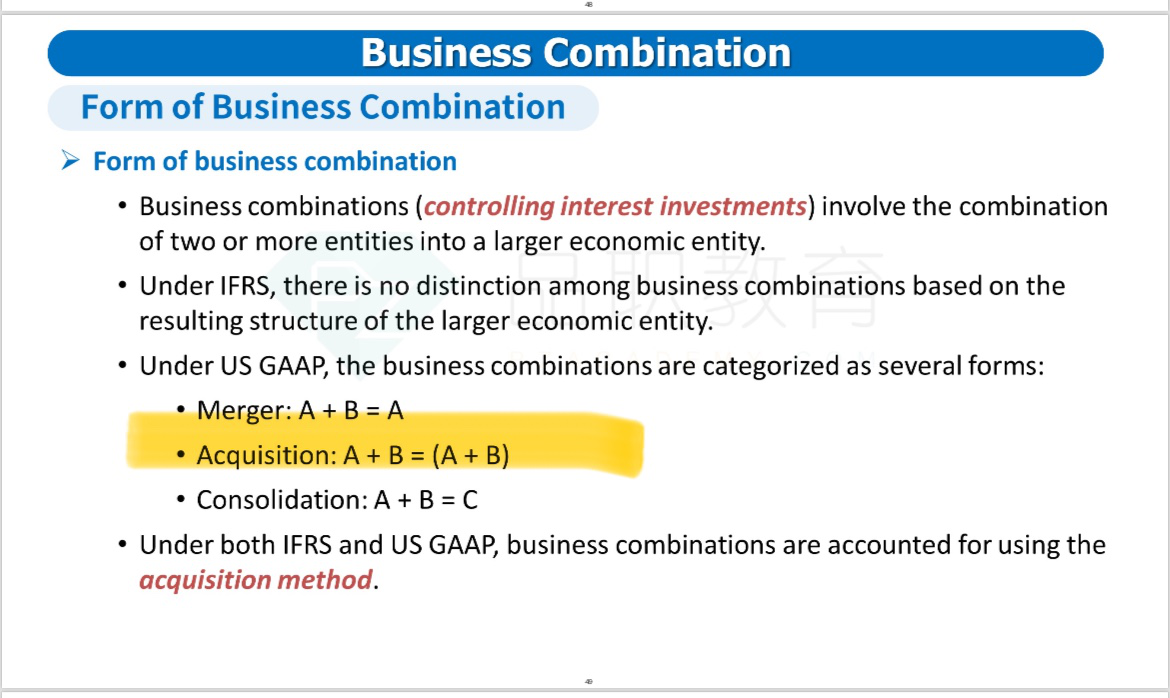

考点:不同的会计方法下对会计比率的影响

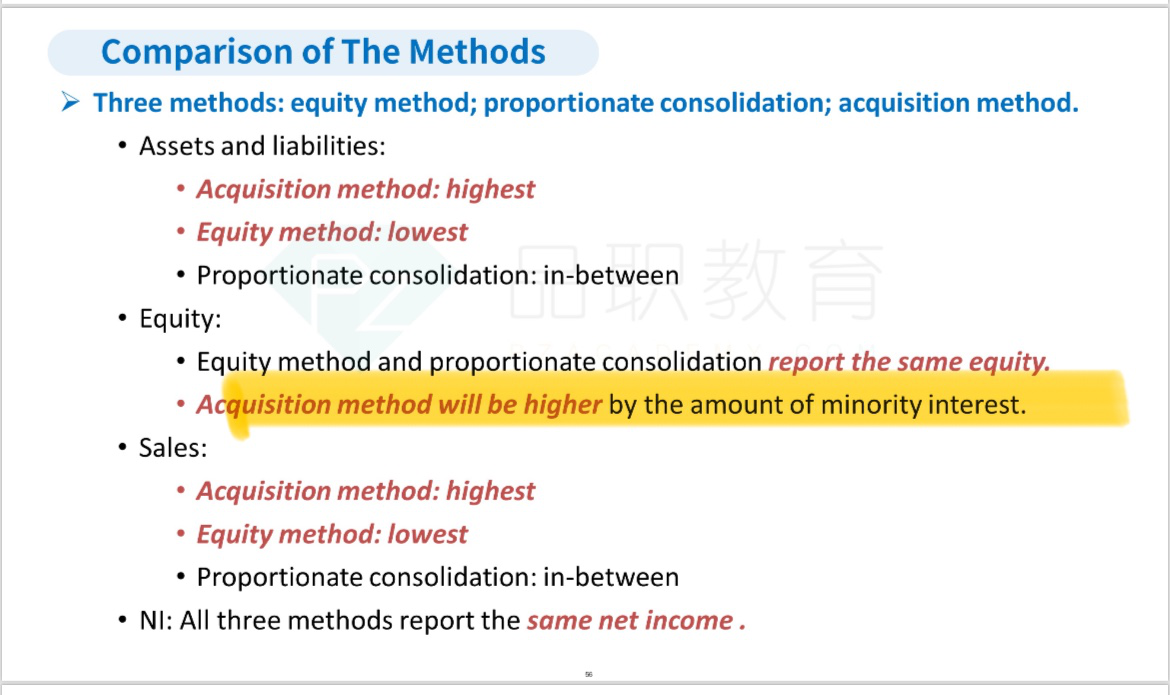

解析:A 选项因为是control,所以用acquisition method,由于不是100%控股,那么在合并报表之后,母公司的资产负债表合并了子公司100%的资产和负债。合并的Equity会增加一个minority interest(用于调平报表)。

B选项因为是significant influence,所以用equity method,对于母公司来说,cash减少一笔,资产里的增加一笔相同的金额的investment in associate, Equity是不改变的。

因此在acquisition method下,母公司的equity是最大的。选项A正确。

business combination下,母公司还有单独的报表吗?如果有,那么这里equity是否和equity method相同?