NO.PZ2024030503000204

问题如下:

Question

选项:

A.less than free cash flow to the firm. B.equal to free cash flow to the firm. C.greater than free cash flow to the firm.解释:

Solution-

Incorrect because FCFE is equal to FCFF.

-

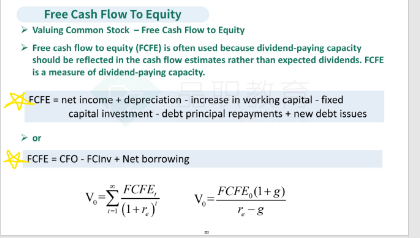

Correct because under U.S. GAAP, free cash flow to the firm is calculated as CFO + int (1− tax rate) – capital expenditures. Since the firm has interest bearing debt outstanding, $18,000 ($30,000 × (1 − .4)) is added back to CFO in calculating FCFF. In addition, the capital expenditures of $82,000 are subtracted so the equation becomes CFO + $18,000 − $82,000 for a net decrease to CFO of $64,000 ($18,000 − $82,000 = − $64,000). The calculation for free cash flow to equity is CFO – capital expenditures + net borrowing with no adjustment for interest paid under U.S. GAAP. The calculation becomes CFO − $82,000 + $18,000 for a net decrease to CFO of $64,000 (− $82,000 + $18,000). Therefore, FCFE will be equal to FCFF; as the after-tax interest add-back to FCFF is equal to the net borrowing add-back to FCFE and CFO and capital expenditures are the same for both.

-

Incorrect because FCFE is equal to FCFF.

•

是不是因为刚好题目给出的条件,int(1-t)恰好等于net borrowing,所以FCFF和FCFE相等