NO.PZ2023040301000165

问题如下:

A company's management may choose not to use financial

leverage because the company has:

选项:

A.an investment-grade credit

rating

a high degree of operating leverage

a lower net debt to EBITDA ratio than its peers

解释:

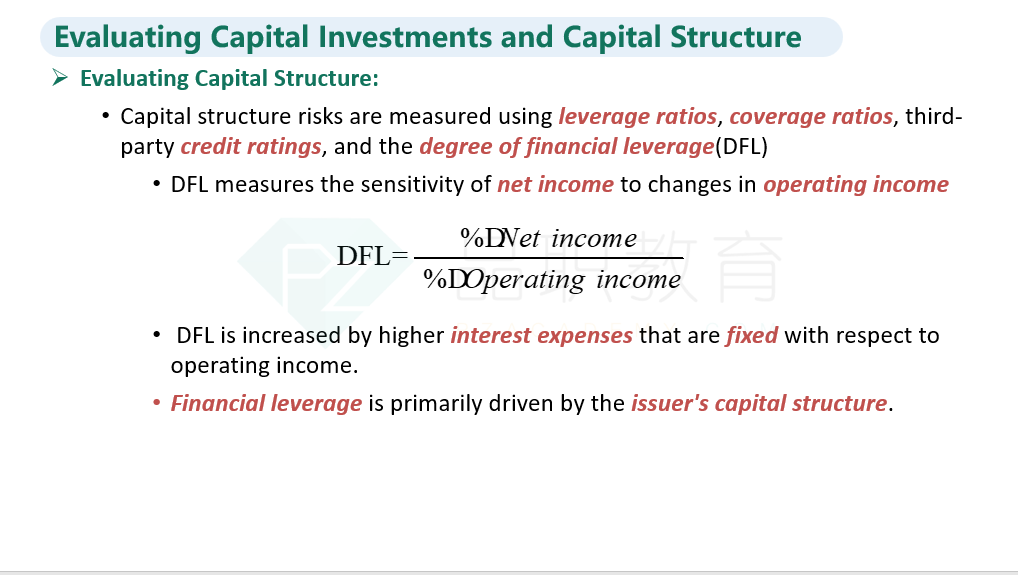

B is correct. The

degree of financial leverage and the degree of operating leverage together

equal the degree of total leverage in the business. If the company already has

a high degree of operating leverage, using financial leverage may increase

total leverage and risk to too high a level.

A is incorrect. An

investment-grade credit rating generally indicates that the company could

borrow economically, which would be a reason to use financial leverage.

C is incorrect. A

lower net debt to EBITDA ratio than its peers is an indicator of borrowing

capacity, which would be a reason to use financial leverage.

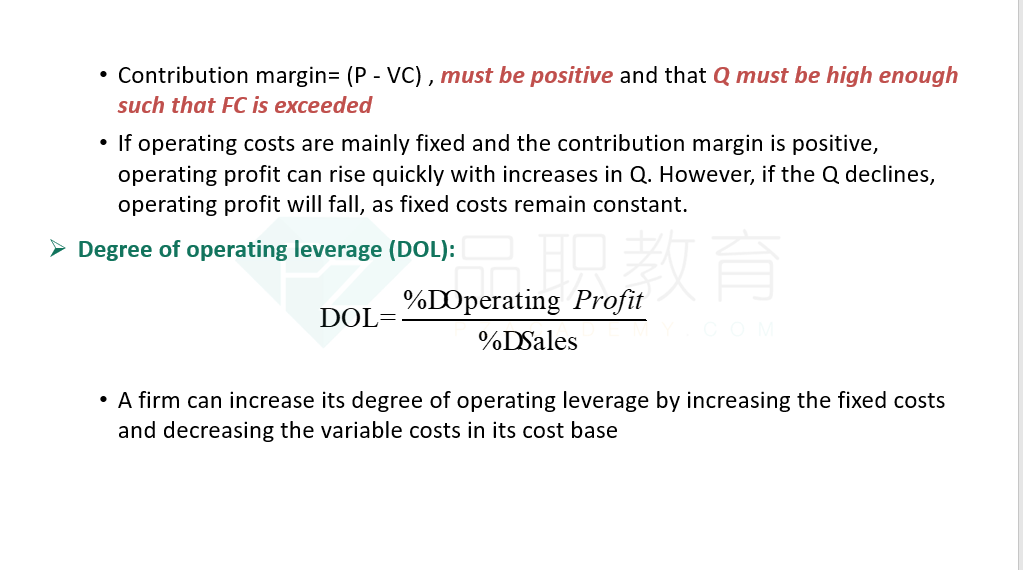

The degree of financial leverage and the degree of operating leverage together equal the degree of total leverage in the business. If the company already has a high degree of operating leverage, using financial leverage may increase total leverage and risk to too high a level.

这个 financial leverage、operating leverage和total leverage 有什么数量关系吗?

还是单纯两个放在一起考虑,组成了total。