NO.PZ2023041003000049

问题如下:

Solomon observes that the market price of the

put option in Exhibit 2 is $7.20. Lee responds that she used the historical

volatility of the GPX of 24% as an

input to the BSM model, and she explains the implications for the implied volatility

for the GPX.

Based

on Solomon’s observation about the model price and market price for the put

option in Exhibit 2, the implied volatility for the GPX is most likely:

选项:

A.less than the historical volatility.

equal to the historical volatility.

greater than the historical volatility.

解释:

The put is priced at $7.4890 by the BSM model

when using the historical volatility input of 24%. The market price is $7.20.

The BSM model overpricing suggests the implied volatility of the put must be lower

than 24%.

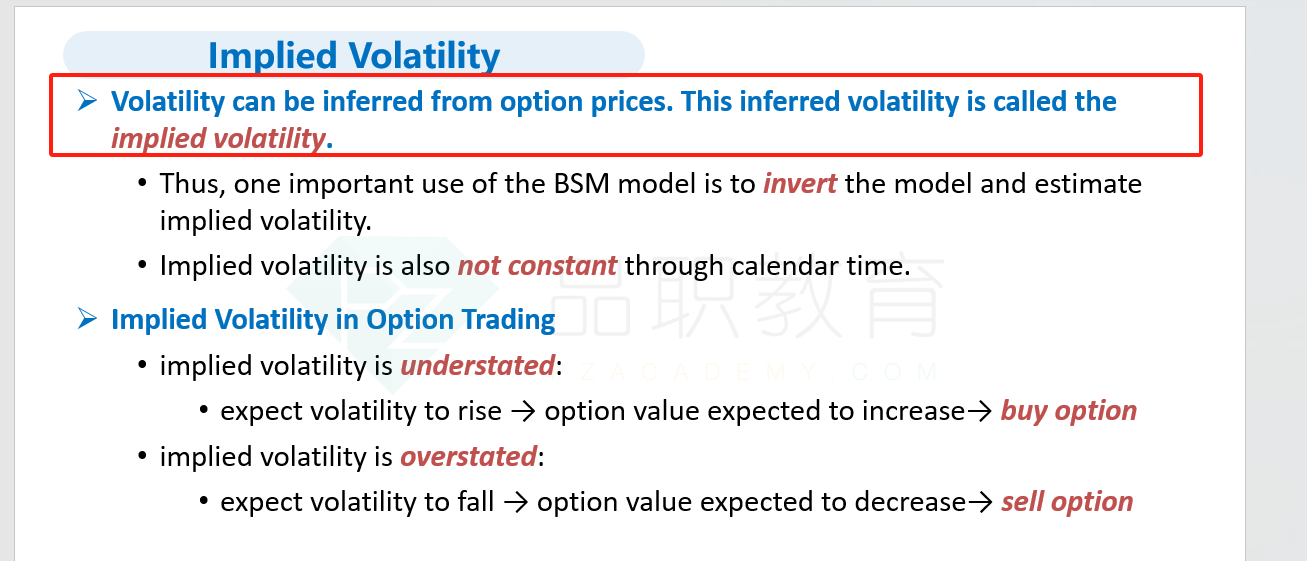

根据强化课,我记得笔记是如果implied 波动率小于市场波动率则buy option 反之则sell。但是这道题将BSM中的波动率称作historical,将市场的称作为implied,,,所以implied 到底是指bsm模型中输入的波动率还是市场价格中隐含的波动率呀?