NO.PZ2016082402000034

问题如下:

According to an in-house research report, it is expected that USDJPY (quoted as JPY/USD) will trade near 97 at the end of March. Frankie Shiller, the investment director of a house fund, decides to use an option strategy to capture this opportunity. The current level of the USDJPY exchange rate is 97 on February 28. Accordingly, which of the following strategies would be the most appropriate for the largest profit while the potential loss is limited?

选项:

A.

Long a call option on USDJPY and long a put option on USDJPY with the same strike price of USDJPY 97 and expiration date

B.

Long a call option on USDJPY with strike price of USDJPY 97 and short a call option on USDJPY with strike price of USDJPY 99 and the same expiration date

C.

Short a call option on USDJPY and long a put option on USDJPY with the same strike price of USDJPY 97 and expiration date

D.

Long a call option with strike price of USDJPY 96, long a call option with strike price of USDJPY 98, and sell two call options with strike price of USDJPY 97, all of them with the same expiration date

解释:

ANSWER: D

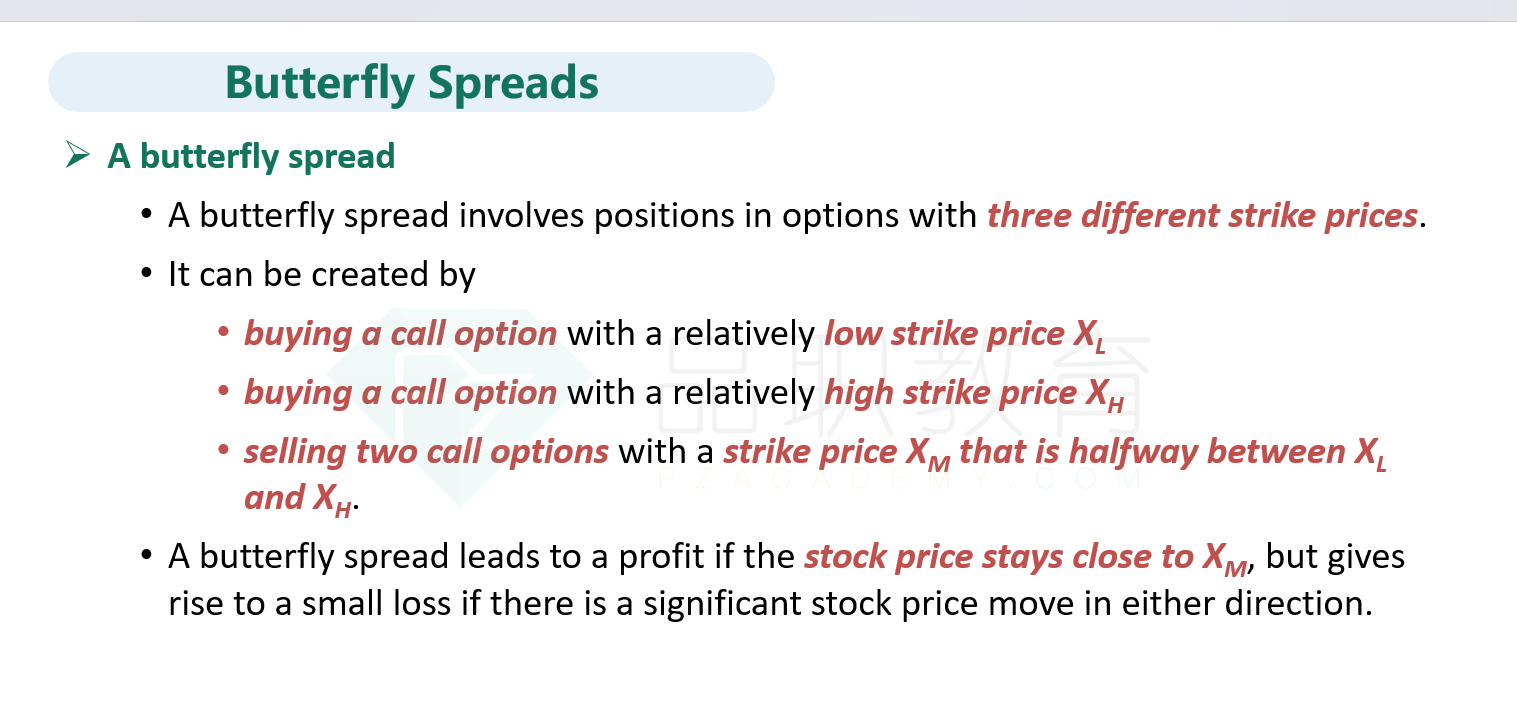

The best strategy among these is a long butterfly, which benefits if the spot stays at the current level. Answer A is a long straddle, which is incorrect because this will lose money if the spot rate does not move. Answer B is a bull spread, which is incorrect because it assumes the spot price will go up. Answer C is the same as a short spot position, which is also incorrect.

为什么波动小用butterfly,butterfly不应该在短中长三个期限上做文章吗?