NO.PZ2023100703000079

问题如下:

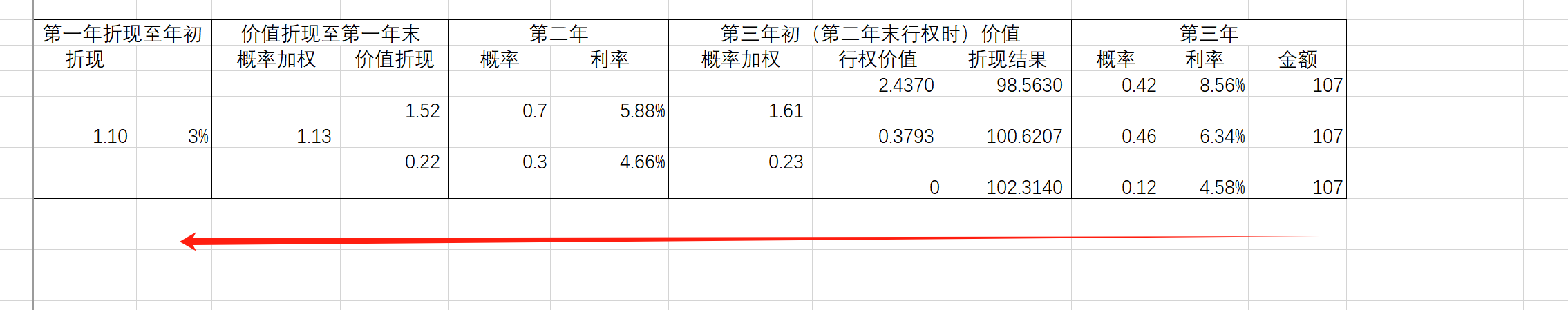

A European put option, which would be expired in two years, has a strike price of $101.00. The underlying bond has three years to maturity with 7% annual coupon. It is known that the risk-neutral probability of an downward move is 0.3 in year 1 and 0.4 in year 2. The current interest rate is 3.00% At the end of year l, the rate will either be 5.88% or 4.66%. If the rate in year 1 is 5.88%, it will either rise to 8.56% or rise to 6.34% in year 2. If the rate in year 1 is 4.66%, it will either rise to 6.34% or decrease to 4.58%. The value of the put option today is closest to:

选项:

A.1.1

B.1.32

C.1.48

D.1.99

解释:

感谢,想看看解析谢谢!