NO.PZ2022071101000007

问题如下:

A credit analyst is evaluating the liquidity of a small regional bank while preparing a report for a credit committee meeting. With quarterly financial statements, the analyst calculates some relevant liquidity indicators over the past three years. Which of the following trends over this period should the analyst be most concerned about in the credit risk report?

选项:

A.

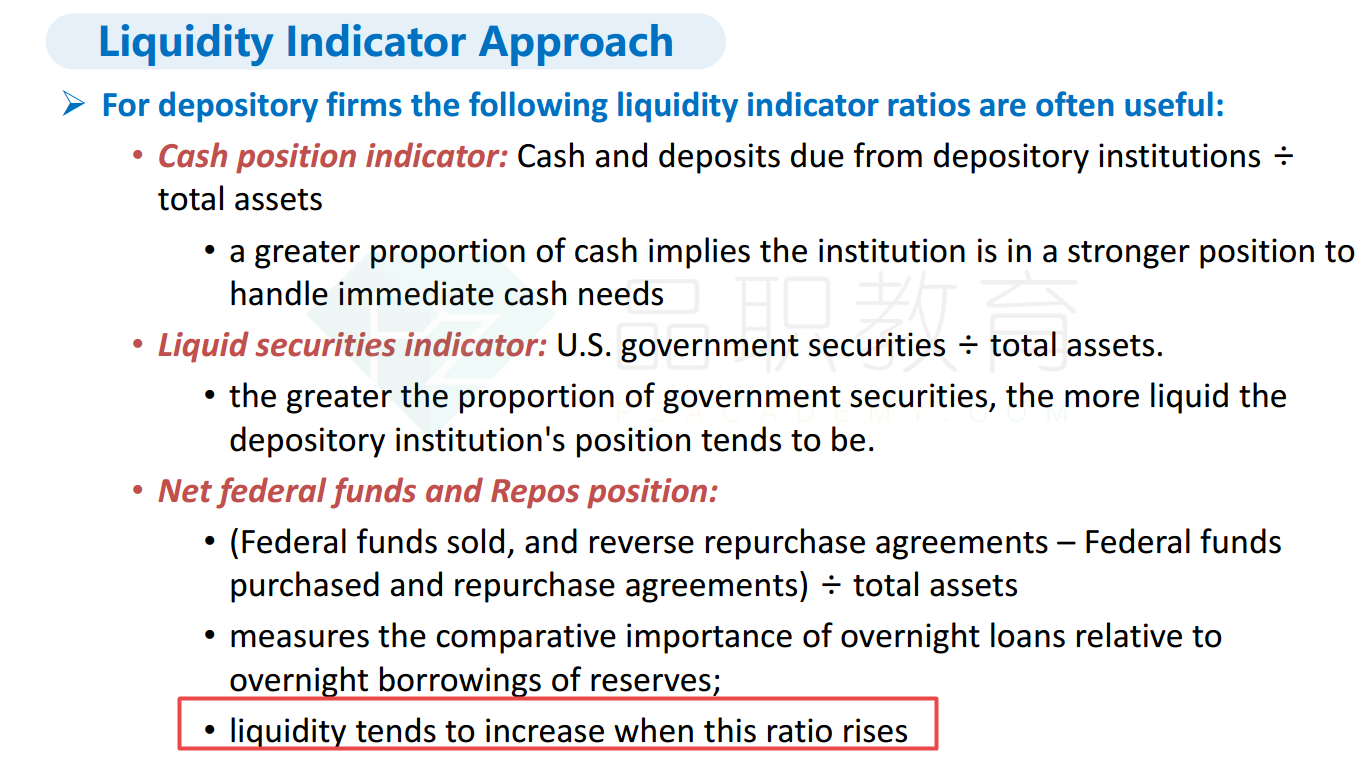

The bank’s average net federal funds and repurchase agreements position has been increasing.

B.

The bank’s capacity ratio has been increasing.

C.

The bank’s pledged securities ratio has been decreasing.

D.

The bank’s loan commitments ratio has been decreasing.

解释:

中文解析:

B是正确的。capacity ratio=(净贷款+租赁) / 总资产,所以当贷款和租赁这些流动性较弱的资产的占比上升时,流动性是下降的。

A不正确。当隔夜贷款相对于隔夜借款增加时,流动性就会增加。

C不正确。当更少的债券被质押时,流动性上升。

D不正确。当贷款承诺相对于总资产减少时,流动性就会增加。

--------------------------------------------------------------------------------------------------------------------

B is correct. Capacity ratio is the ratio of net loans and leases to total assets, so liquidity decreases when net loans and leases increase relative to total assets, because they are often illiquid.

A is incorrect. Liquidity increases when overnight loans increase relative to overnight borrowing.

C is incorrect. Liquidity increases when fewer securities are pledged/unavailable to sell relative to total securities.

D is incorrect. Liquidity increases when loan commitments decreases relative to total assets.

A 答案,1.SOLD-buy=net federal fund吗?2.repo增加,分子减少,怎么会是增加ratio?