NO.PZ202403120100000203

问题如下:

Which of Rosse’s three valuation factors would most likely not be classified as a relative valuation approach?

选项:

A.Factor 1

B.Factor 2

C.Factor 3

解释:

A Correct. Capitalization rates are used as an input to calculate net operating income when calculating net worth, or net asset value, which is not a market-based relative value approach.

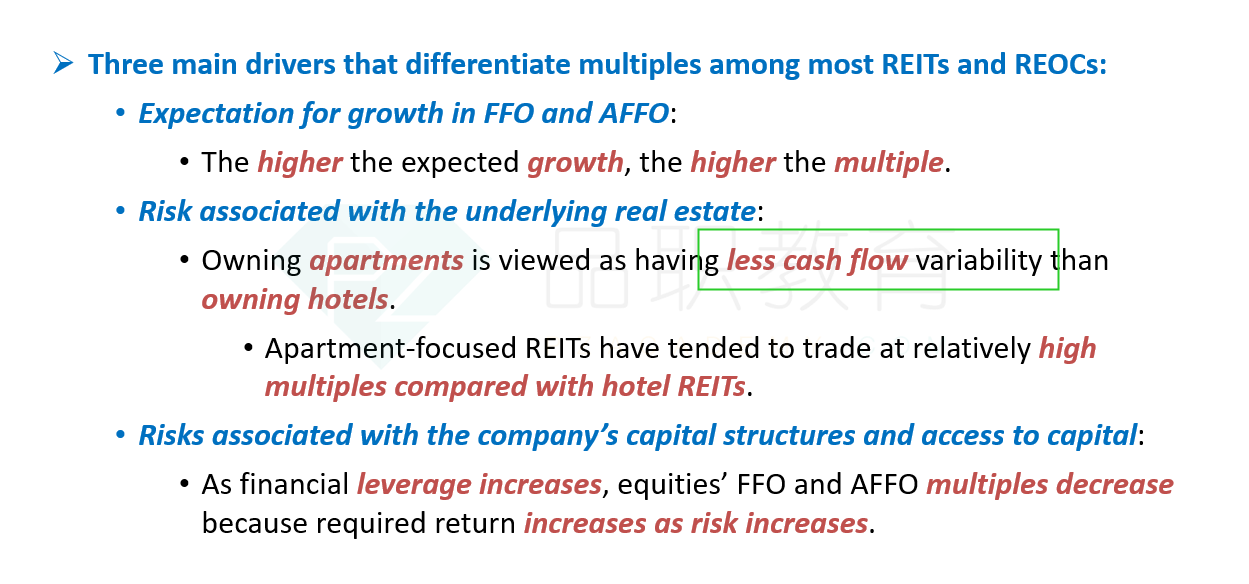

B Incorrect. Factor 2 describes inputs to a relative value (or market-based) approach to valuing REIT stocks.

C Incorrect. Factor 3 describes inputs to a relative value (or market-based) approach to valuing REIT stocks.n

factor 2在相对方法中哪里用到了呀