NO.PZ202304050100017002

问题如下:

The average market price for SKI shares at the time of settlement for the RSUs that vested in 20X2 was SGD 71.50. Assuming a statutory tax rate of 17%, the impact to SKI’s income tax expense for 20X2 related to share-based compensation is closest to:

选项:

A.

a SGD 29.6 million increase in income tax expense.

B.

a SGD 29.6 million reduction in income tax expense.

C.

a SGD174.1 million reduction in income tax expense.

解释:

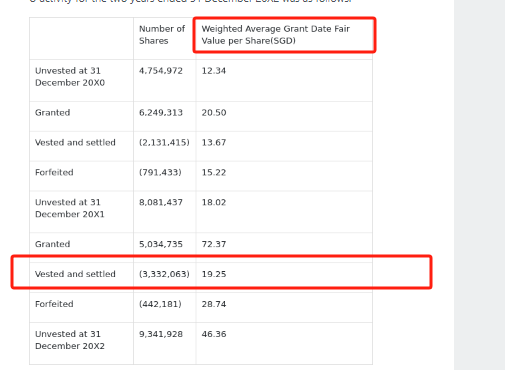

B is correct. The excess tax benefit or windfall in 20X2 isequal to the statutory tax rate multiplied by the amount that the tax deductionassociated with the settlement of the share-based award exceeds the share-basedcompensation expense recognized on the income statement: statutory tax rate x(tax deduction–share-based compensation expense). This is equal to 0.17 x [(71.50 x 3,332,063)– (19.25 x 3,332,063)] =29,597,050.

框架图上算差异是按照grant day 股价和settle 股价算差额