NO.PZ2022083003000001

问题如下:

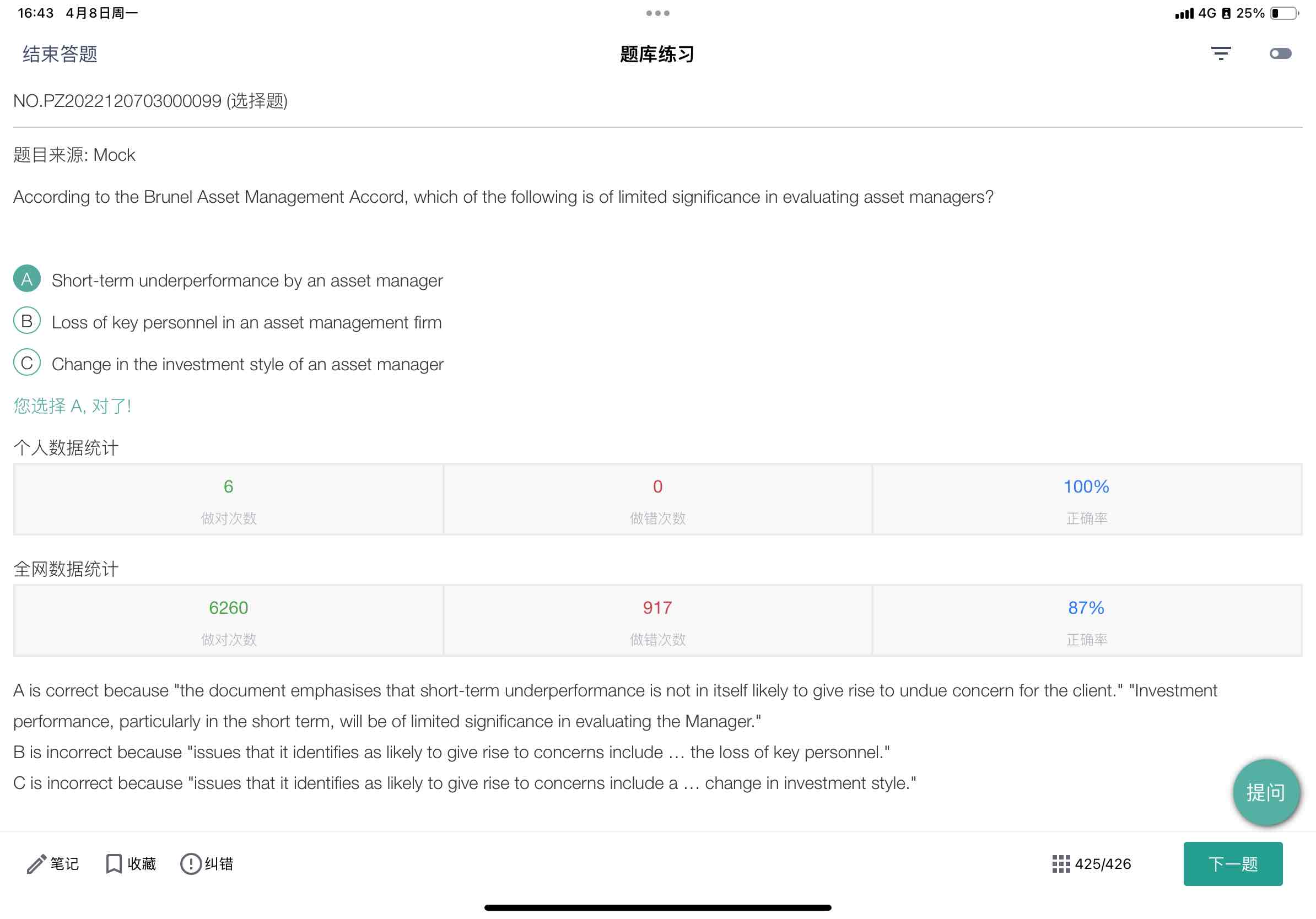

Which of the following, according to the Brunel Asset Management Accord, is NOT in itself a likely cause for concern?

选项:

A.

Failure to manage risk appropriately.

B.

A change in the expected investment style.

C.

Short-term underperformance.

D.

Lack of understanding of reasons for underperformance.

解释:

本题考察布鲁内尔资产管理协议相关内容。

The Brunel Asset Management Accord highlights that clients should concern much more about culture and fail to adhere to the expected investment process or style.

- Persistent failure to adhere to Brunel’s investment principles and the spirit of the accord.

- A change in investment style, or investments that do not fit into the expected style.

- Lack of understanding of reasons for any underperformance, and/or a reluctance to learn lessons from mistakes. Conversely, complacency after good performance should be avoided.

- Failure to follow the investment restrictions or manage risk appropriately, including taking too little risk.

- Organisation instability or the loss of key personnel.

后面好几题,都说short-term ,这不应该说明C是对的么。。