NO.PZ2022062601000026

问题如下:

Company H has shifted to a hedge fund strategy that focuses specifically on volatility trading. Add this fund (Fund A) to the investor's investment portfolio in an effort to hedge long equity positions. Fund A typically implement the following three types of transactions in their strategies:

- Trade 1: Sell exchange-traded and over-the-counter equity call options on a market index.

- Trade 2: Sell VIX futures to capture the volatility premium and roll-down payoff.

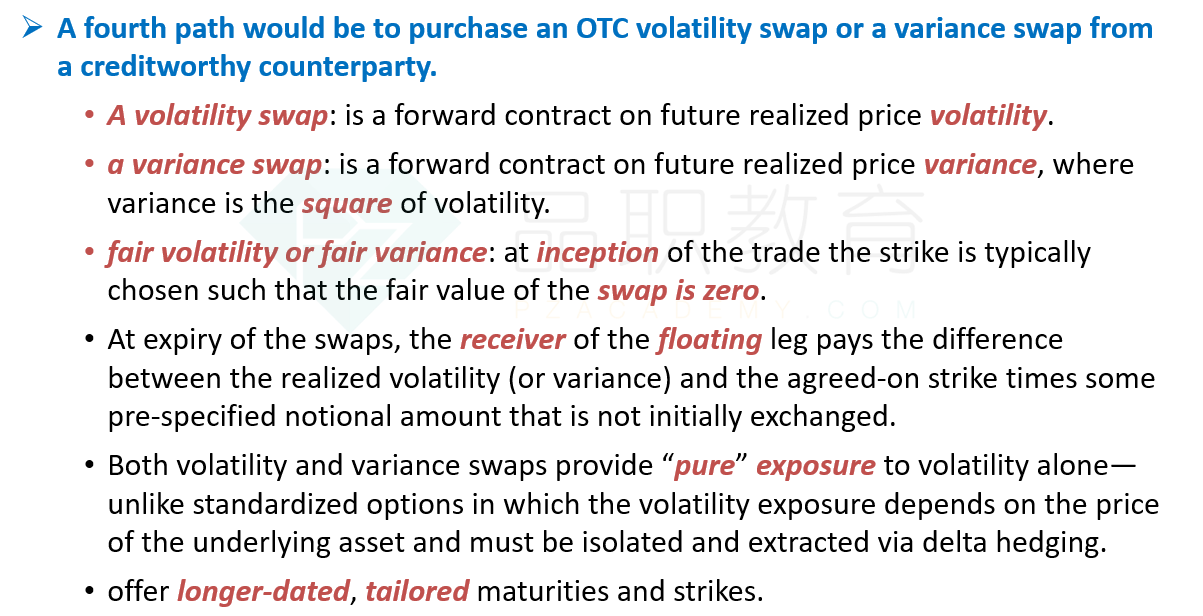

- Trade 3: Purchase a receiver volatility swap with an at-inception fair value of zero.

选项:

A.Trade 1

Trade 2

Trade 3

解释:

C is correct. There is a negative correlation between equities and volatility. A long volatility positions are necessary to hedge equity exposure in investment portfolios. Trade 1 is a short volatility position and will not hedge against equity positions as it requires a long volatility position. Trade 2 is also a short position in volatility; Its purpose is to charge a premium for selling volatility. This type of transaction will be carried out simultaneously with the equity sell-off, providing hedging. Trade 3 is a direct purchase of volatility through swaps, providing a pure long exposure and hedging the existing equity exposure in the portfolio.

A is incorrect. A short volatility position will not hedge the equity position since a long volatility position is needed.

B is not correct. Trading 2 is a short position in volatility; Its purpose is to charge a premium for selling volatility. This type of transaction will be sold simultaneously with the stock sell-off, therefore no hedging is provided.

知识点考察:volatility trading

从题干看出其目的是要对冲做多股票的风险敞口,而股票和波动率成反向关系,所以应该做多波动率来达到题干的目的。而trade1 2 3中只有trade 3是做多波动率的。所以选项trade 3。

知识点二级好像没有学?