NO.PZ2023020101000018

问题如下:

Whitney meets with Grand Manufacturing.

This client is based in Hong Kong but requires a €25,000,000 one-year bridge

loan to fund operations in Germany. Grand Manufacturing is currently able to

borrow euros at an interest rate of 3.75% but wonders if there is a less

expensive alternative. Whitney advises Grand to borrow in HK$ and enter into a

one-year foreign currency swap with quarterly payments to receive euros at a fixed

rate and pay HK$ at a fixed rate. The current exchange rate is HK$11.42 per €1,

and the notional amounts will be exchanged at initiation and at maturity.

Ninety days have passed since Whitney’s

initial meetings, and in the interim interest rates have increased dramatically.

Whitney’s clients have asked to meet with her to review their positions.

In order to prepare for the meeting,

Whitney has obtained updated interest rate data that is presented in Exhibit 2.

In addition, she determines that the exchange rate for the Hong Kong dollar is

HK$9.96 per €1, and the US stock index is at 905Exhibit 2: Present Value Factors

Based on Current Australian Term Structure.

Exhibit 2

Term Structure of Rates 90 Days Later (%)

Note: Euribor is

Euro Interbank Offered Rate. Hibor is the Hong Kong Interbank Offered Rate. All

rates shown are annualized

Using the data in Exhibit 2, the market value of Grand

Manufacturing’s swap after 90 days is closest to:

选项:

A.–€4,103,142

€2,701,178

C.

€3,625,900

解释:

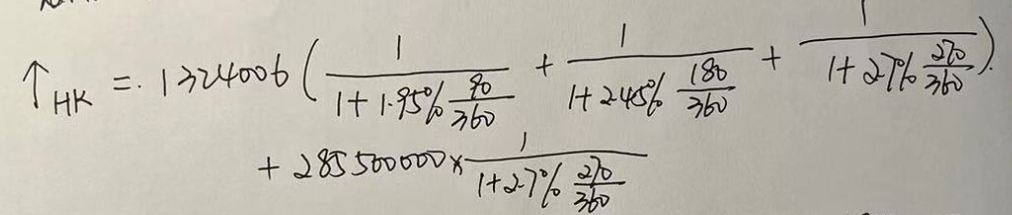

Grand borrows HK$285,500,000 and exchanges it for €25,000,000 based on the initial exchange rate of HK$11.42 per euro.

Grand will pay an interest rate of 1.8550%

on the borrowed HK dollars and earn 2.3181% on the lent/invested euros.

Ninety days into the swap, the exchange

rate is HK$9.96, and the PV factors are:

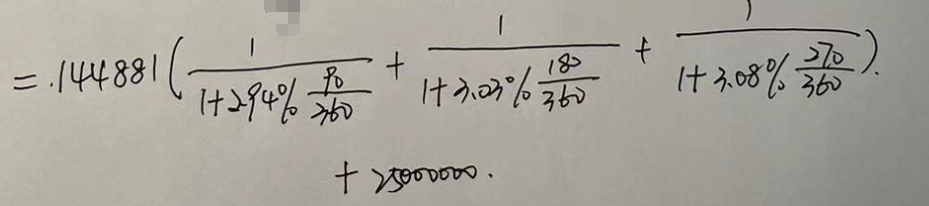

=285,500,000/HK$/€9.96×[0.004637(2.9632)+0.980152]-€25,000,000×[0.005795(2.9552)+0.977422] =€28,489,585-€24,863,685=€3,625,900

老师您好,这道题我比较乱,您能帮我画个图吗,感谢