NO.PZ202206210100000404

问题如下:

The asset allocation choice in Exhibit 2 that has the highest probability of meeting the committee’s desired return criteria is allocation:选项:

A.3 B.1 C.2解释:

SolutionC is correct. The allocation that has the highest probability of meeting the target return of 5% annually generates the highest value for the ratio: (expected annual return – target return)/return volatility, which is Ratio 2 in Exhibit 2. Allocation 2 has the highest value for this ratio.

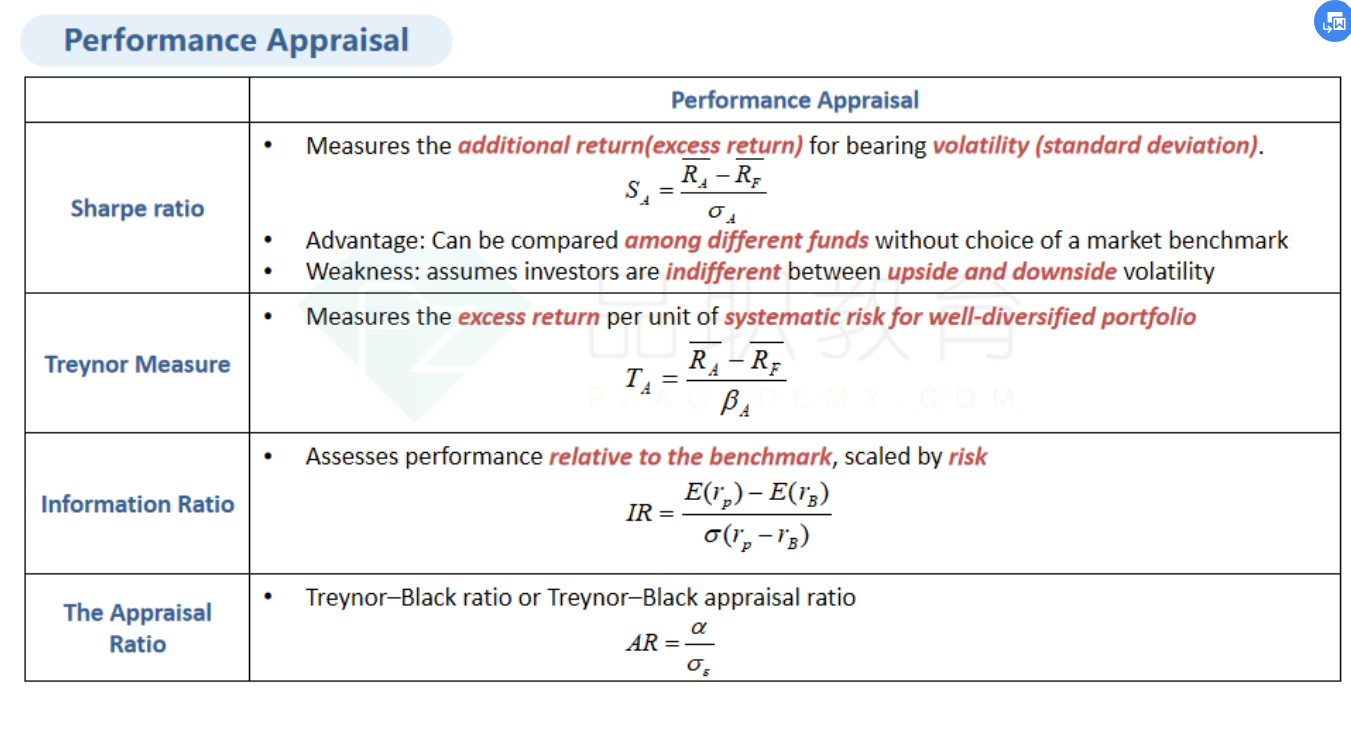

B is incorrect. Allocation 2 has the highest value for Ratio 2. Allocation 1 has the highest Sharpe Ratio.

A is incorrect. Allocation 2 has the highest value for this Ratio 2. Allocation 3 has the highest Treynor Measure.

RT