NO.PZ2023090507000008

问题如下:

XYZ corporation has a capital structure of 30% debt and 70% equity, and interest expense is tax deductible. Debt investors require a before-tax return of 6%, and equity investors’ required return is 12%. If the marginal corporate tax rate rises from 20% to 25%, the change in the WACC is closest to:

选项:

A.–0.09%.

0.09%.

0.30%.

解释:

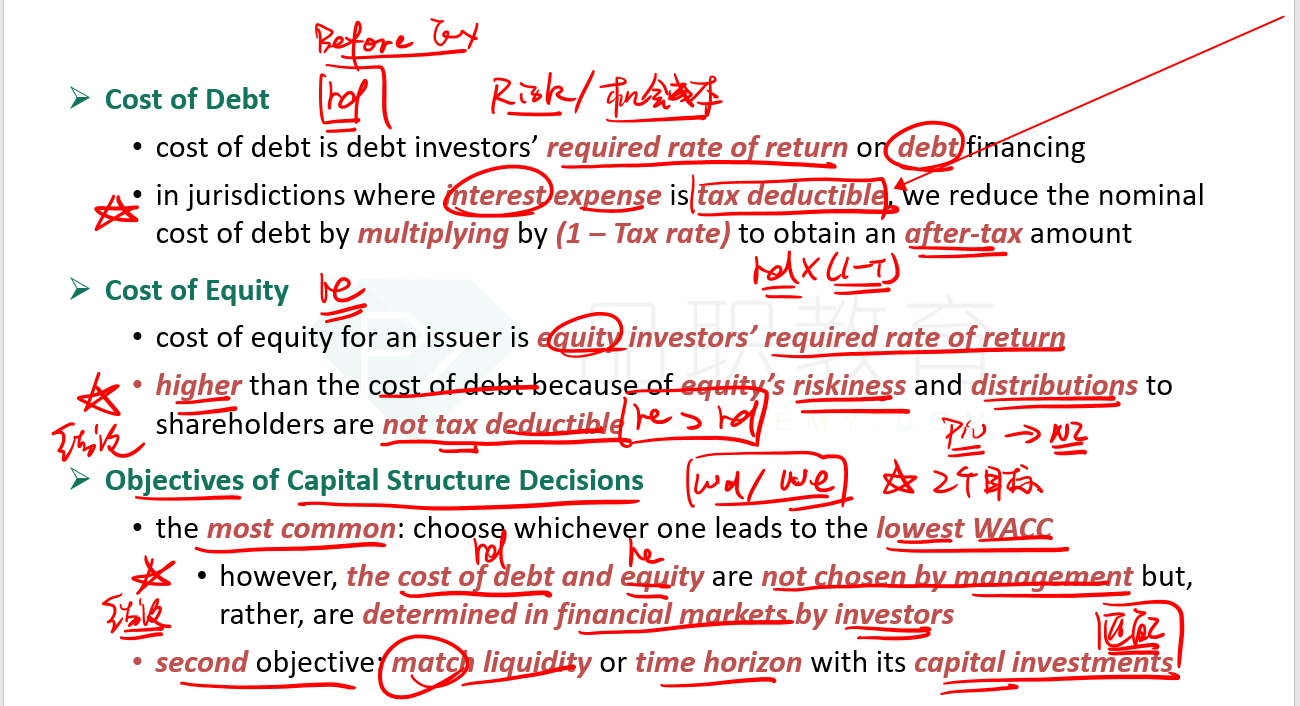

A is correct. XYZ’s WACC at a tax rate of 20% is calculated as follows:

WACC = (Weighting of debt × Cost of debt) + (Weighting of equity × Cost of equity)

= (0.3)(6%)(1 – 0.2) + (0.70)(12%) = 9.84%.

XYZ’s WACC at a tax rate of 25% is calculated as follows:

WACC = (0.3)(6%)(1 – 0.25) +(0.70)(12%) = 9.75%.

Thus, WACC declines by 0.09% as the after after-tax cost of debt declines from 4.8% to 4.5%.

为什么有负号了