NO.PZ2018103102000089

问题如下:

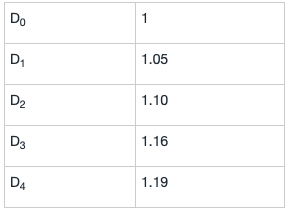

Matt is evaluating the value of Company M by using the dividend discount model. The most recent dividend and the required rate of return are $1.0 per share and 7.5%, respectively. The company will experience a highly growth of 5% during the first three years. Thereafter, the dividend growth rate would be 3% per year into the indefinite future. What`s the value of Company M?

选项:

A.

$22.66

B.

$24.15

C.

$25.15

解释:

B is correct.

考点:Two Stage Model

解析:

=26.44

=24.15

想问一下这种general的model是不是也能用H model 的那种一站式算法,就是直接用3%的永续加上前面5%的部分,【1*(1+3%)+1*3(5%-3%)】/(7.5%-3%)=24.22 和B的24.15误差不大