NO.PZ2024021802000081

问题如下:

Which of the following statements about incorporating ESG factors into valuation inputs is most accurate?选项:

A.Adjustments to the discount rate can be based on individual company factors or on a country or sector basis B.The terminal growth rate is typically a weighted average of the required rates of return by debt and equity investors C.The discount rate should be decreased to account for the risk that future cash flows could be impacted by unpredictable climate policy shifts解释:

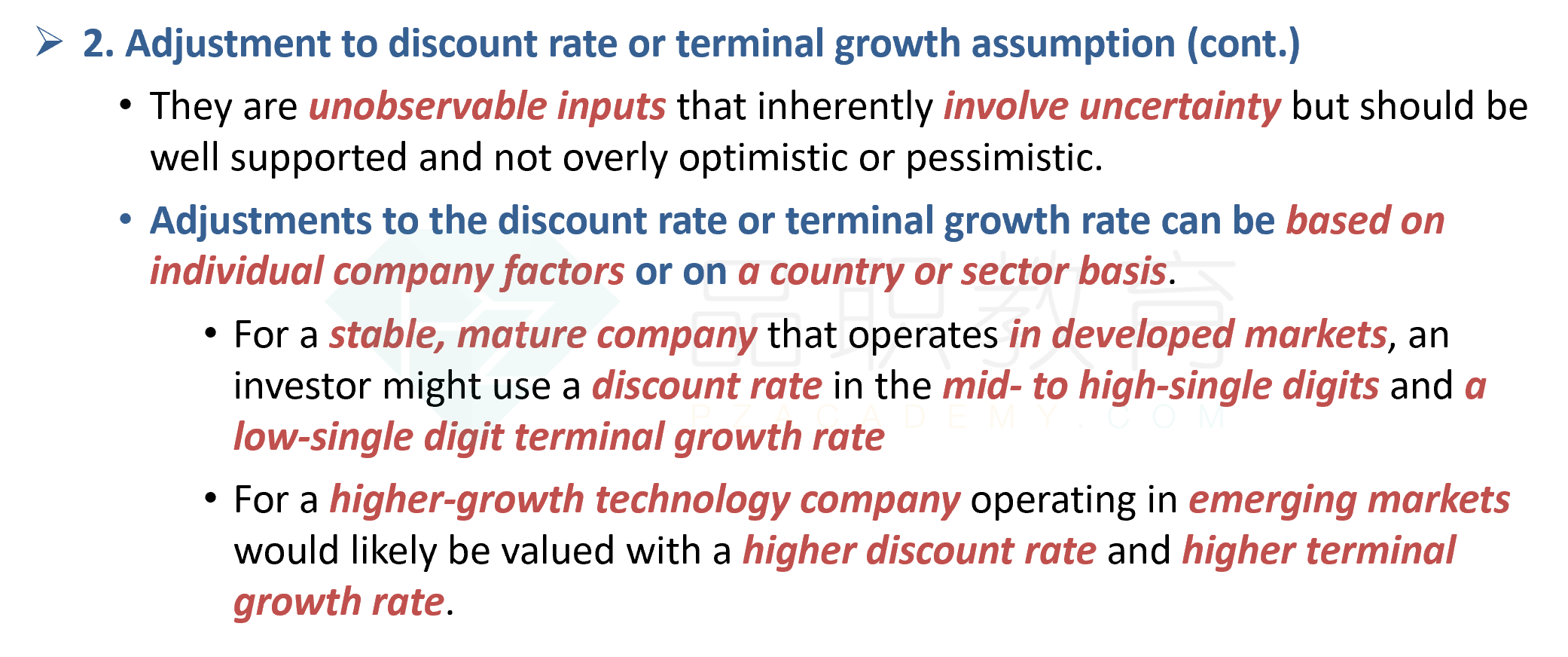

A. Correct because adjustments to the discount rate or terminal growth rate can be based on individual company factors or on a country or sector basis.

B. Incorrect because this response describes the discount rate, not the terminal growth rate. The terminal growth rate is a perpetual compound annual growth rate that a company’s cash flow is assumed to grow by after the discrete forecasting period (e.g., after the next 5 or 10 years of individual forecasts, an analyst assumes cash flows grow by 2% forever); it reflects the company’s growth prospects.

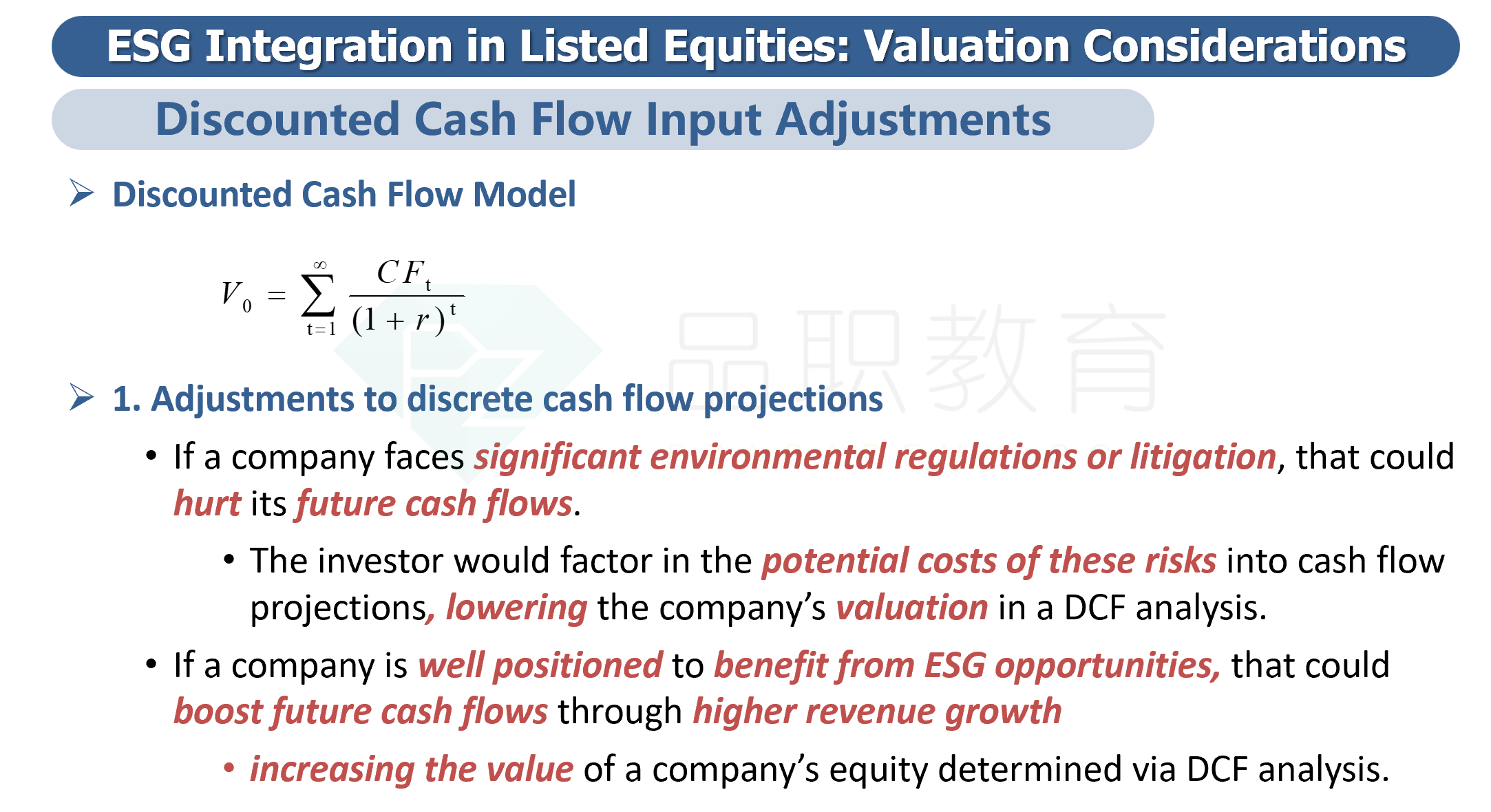

C. Incorrect because if a company faces significant environmental regulations or litigation, that could hurt its future cash flows. The investor would factor in the potential costs of these risks into cash flow projections, lowering the company’s valuation in a discounted cash flow (DCF) analysis. Besides adjustments to discrete cash flow projections, analysts can adjust the discount rate (e.g., required rate of return, cost of capital) or terminal growth assumption in their DCF model to account for material ESG factors. For example, all coal producers and coal-powered utilities might be judged to have higher climate-related risk and thus higher discount rates. Their discount rate should be increased (instead of decreased) to account for the risk that future cash flows could be impacted by unpredictable climate policy shifts.

没有很懂这道题考点是什么,另外为什么选择A