NO.PZ2023081403000026

问题如下:

Q. For its fiscal year-end, Calvan Water Corporation (CWC) reported net income of USD12 million and a weighted average of 2,000,000 common shares outstanding. The company paid USD800,000 in preferred dividends and had 100,000 options outstanding with an average exercise price of USD20. CWC’s market price over the year averaged USD25 per share. CWC’s diluted EPS is closest to:

选项:

A.USD5.33

B.USD5.54

C.USD5.94

解释:

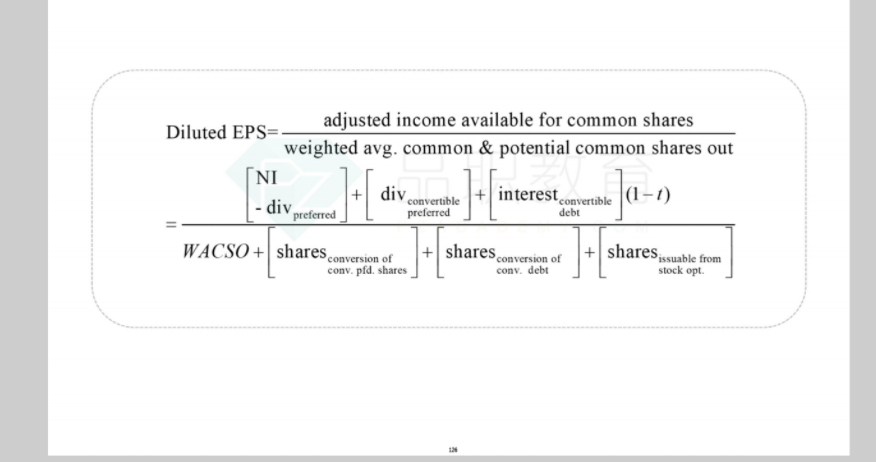

B is correct. The formula to calculate diluted EPS is as follows:

Diluted EPS = (Net income – Preferred dividends)/[Weighted average number of shares outstanding + (New shares that would have been issued at option exercise – Shares that could have been purchased with cash received upon exercise) × (Proportion of year during which the financial instruments were outstanding)].The underlying assumption is that outstanding options are exercised, and then the proceeds from the issuance of new shares are used to repurchase shares already outstanding:

Proceeds from option exercise = 100,000 × USD20 = USD2,000,000Shares repurchased = USD2,000,000/USD25 = 80,000The net increase in shares outstanding is thus 100,000 – 80,000 = 20,000. Therefore, the diluted EPS for CWC = (USD12,000,000 – USD800,000)/2,020,000 = USD5.54.

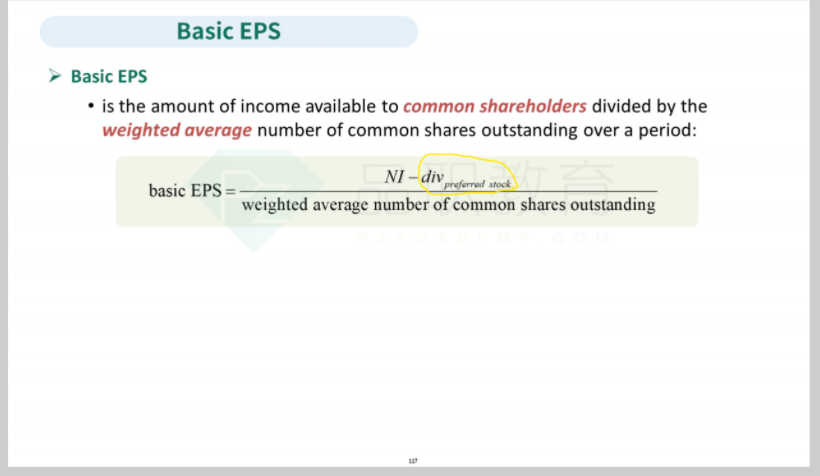

是diluted EPS才需要减股利么 一般EPS不需要