NO.PZ2018070201000077

问题如下:

Which of the following is the optimal portfolio for a individual investor according to the capital market theory?

选项:

A.

the combination of a risk-free asset and a risky asset with the highest expected return.

B.

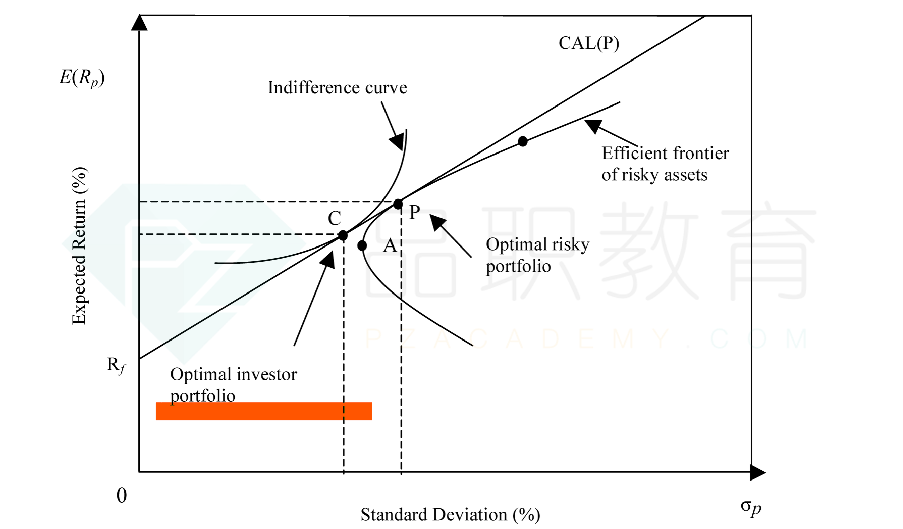

the combination of a risk-free asset and a risky asset with the highest indifference curve.

C.

the combination of a risk-free asset and a risky asset with the highest capital allocation line slope.

解释:

B is correct.

Individuals' optimal portfolios is determined by different indifference curves, which delivers the highest utility. So CAL is tangent to the individual investor’s highest possible indifference curve.

CML是无风险资产与有效前沿切点之间的连线,为何不能认为他的斜率相对其他点连线相较斜率最高?