NO.PZ2023041102000012

问题如下:

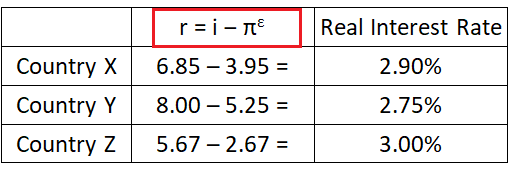

Bergman recommends that AIM should increase holdings in the country that offers the highest real interest rate according to the international Fisher effect. He presents the data in Exhibit 2 for conducting the analysis.

If Bergman's recommendation is followed, AIM will most likely increase its holdings in Country:

选项:

A.Z. B.Y. C.X.解释:

Country Z has the highest real interest rate according to the International Fisher effect. The Fisher effect breaks down the nominal interest rate (i) in a given country into two parts: (1) the real interest rate in that particular country (r) and (2) the expected inflation rate (πɛ) in that country.

i = r + πɛ, where r = Current nominal interest rate and πɛ = Expected inflation rate.

老师,您好!

题中所述:i = r + πɛ, where r = Current nominal interest rate and πɛ = Expected inflation rate. 这一句和上面的描述有悖。i应该是名义利率,r应该是真实利率吧。是吗?麻烦老师解释一下,谢谢!